AS WE NAVIGATE THE difficult road to economic recovery, the wide-format market continues to grow and adapt to pandemic-related shifts in consumer behaviors and trends while prioritizing production cost savings and waste reduction. Purchase and investment trends in software/automation and equipment are changing as print service providers consider the cost benefits of new software subscriptions, renewal of existing workflow solutions, and leveraging new technologies to optimize their production strategies.

In collaboration with Keypoint Intelligence, Big Picture magazine completed a web-based survey of owners and employees of wide-format print businesses to illustrate the trends in applications, purchase intentions, waste reduction, workflow optimization, and revenue expectations. A majority of respondents were from commercial printer businesses, followed by wide-format PSPs, sign shops, and in-house digital print departments.

Let’s look at the key findings of this survey to learn firsthand what PSPs are doing to maintain profitability and gain market share in an ever-changing economy.

Top Wide-Format Applications

THE MOST PRODUCED

APPLICATIONS MAY NOT BE

THE MOST PROFITABLE

In response to which top five wide-format print applications represented the highest average monthly print volumes, banners, decals, and signs understandably were well up in the rankings. Gaining in popularity over the last two years, posters and fine art/photo prints have solidified positions in the top five.

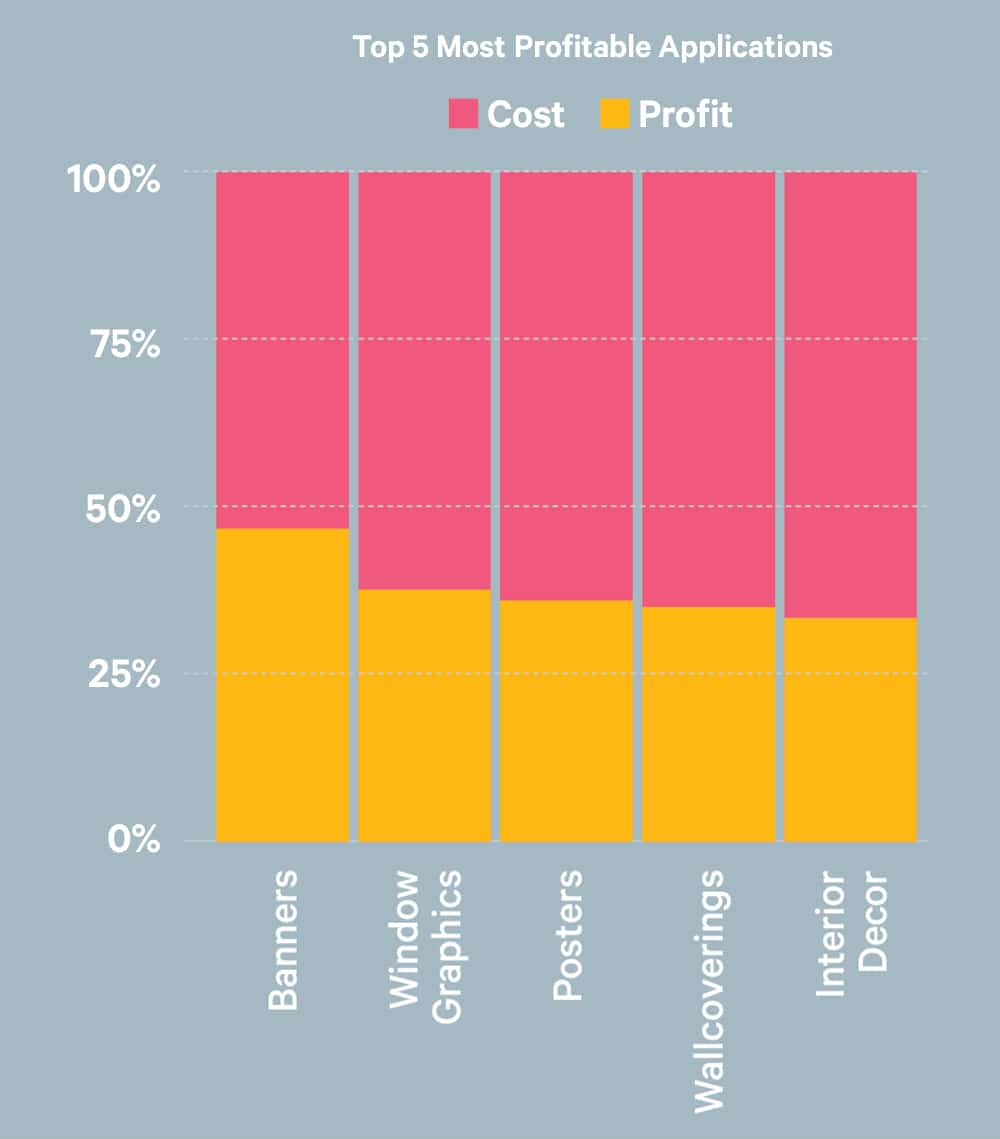

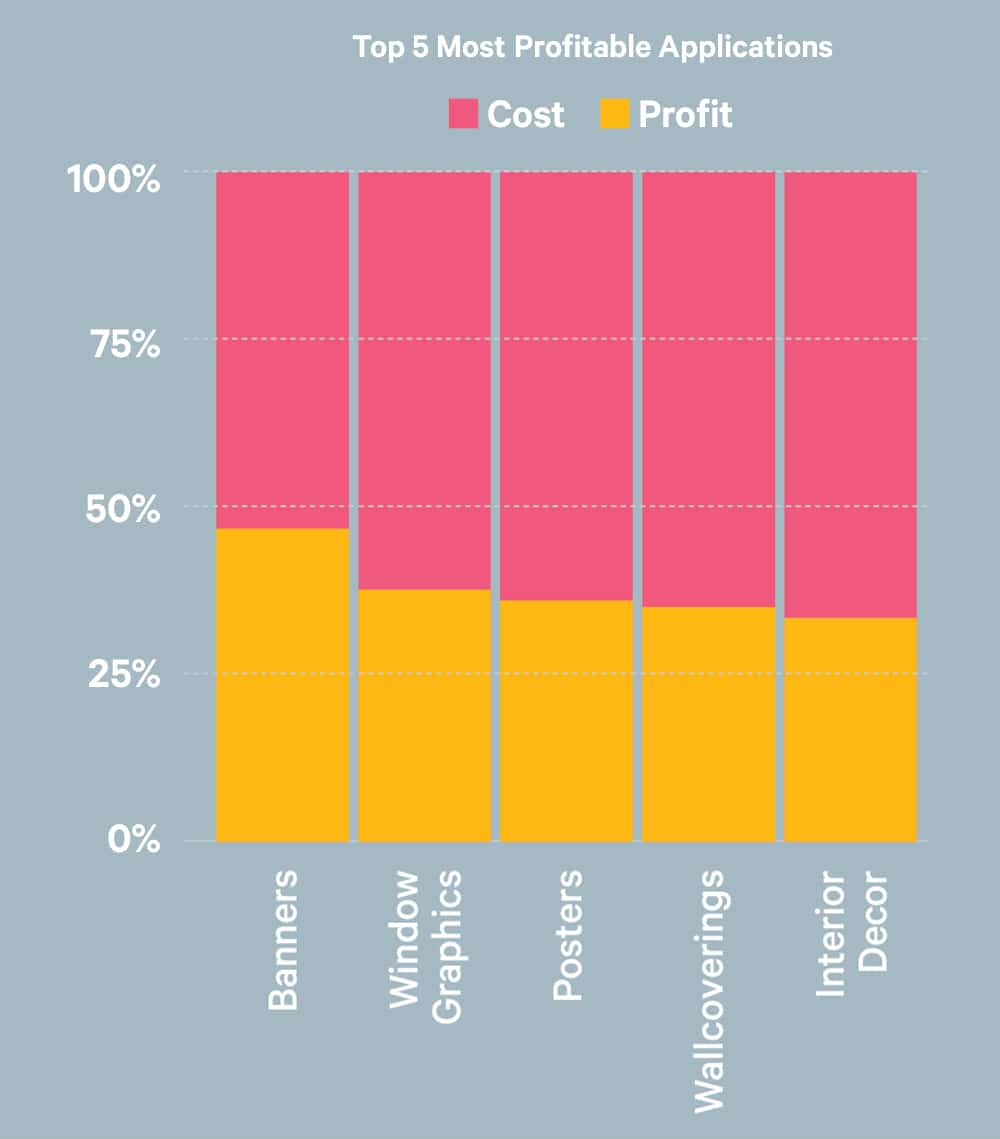

Gross Profit Margin (GPM) for banner applications.

Banners maintained the highest volume ranking while producing a 48 percent gross profit margin (GPM). While all top six leading applications (banners, decals, fine art/photo prints, billboards, posters, and signs) stayed above 23 percent GPM, other, less frequently produced applications proved more profitable.

of errors are solved within four hours.

Following banners at 48 percent, window graphics at 40 percent, posters at 39 percent, wallcoverings at 39 percent, and interior décor at 36 percent all produced more profit than higher volume applications. As profit margins continue to tighten, it’s important for PSPs to guide their sales and marketing strategies toward the most profitable applications.

EQUIPMENT TRENDS

VARY DEPENDING ON

THE TYPE OF PSP

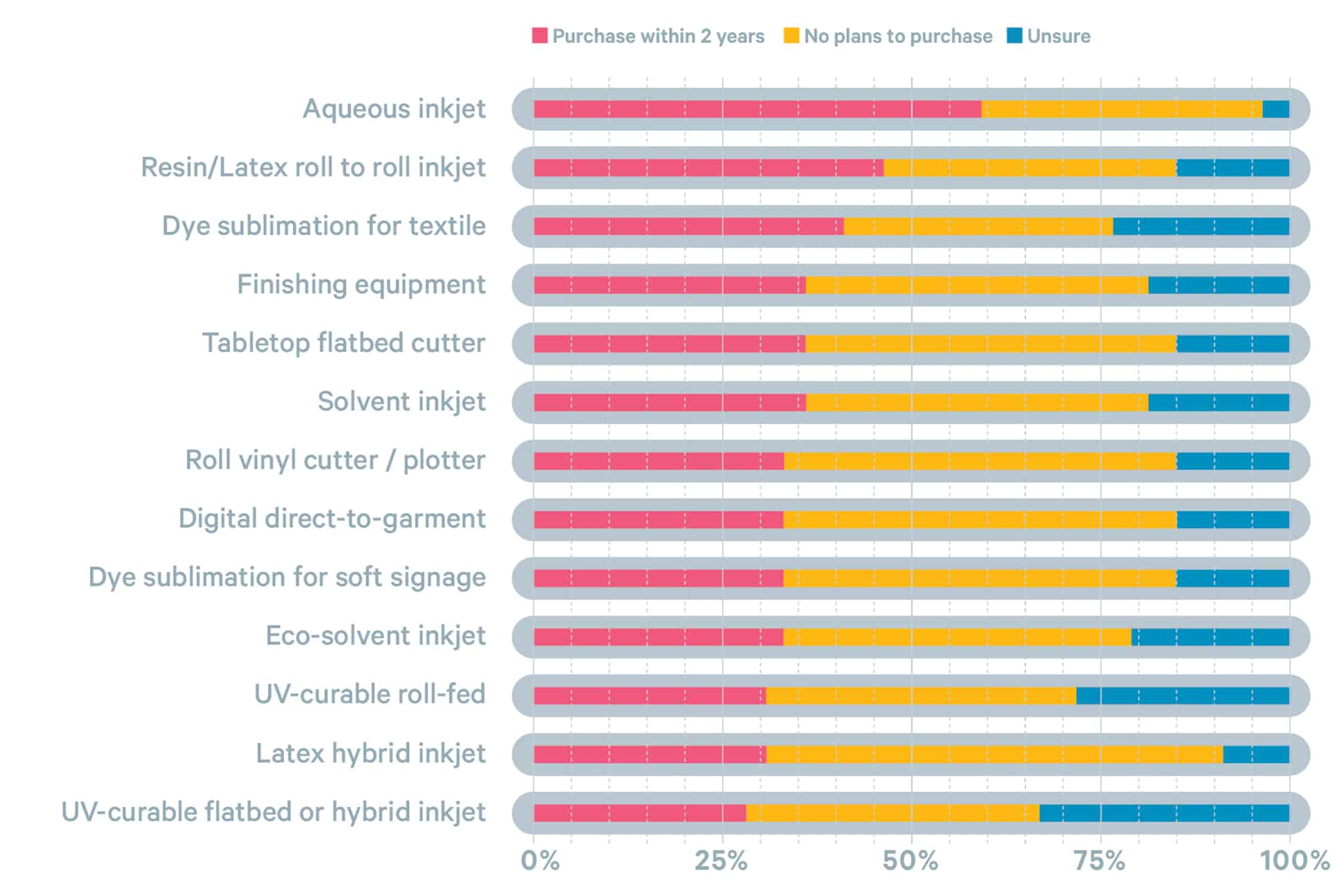

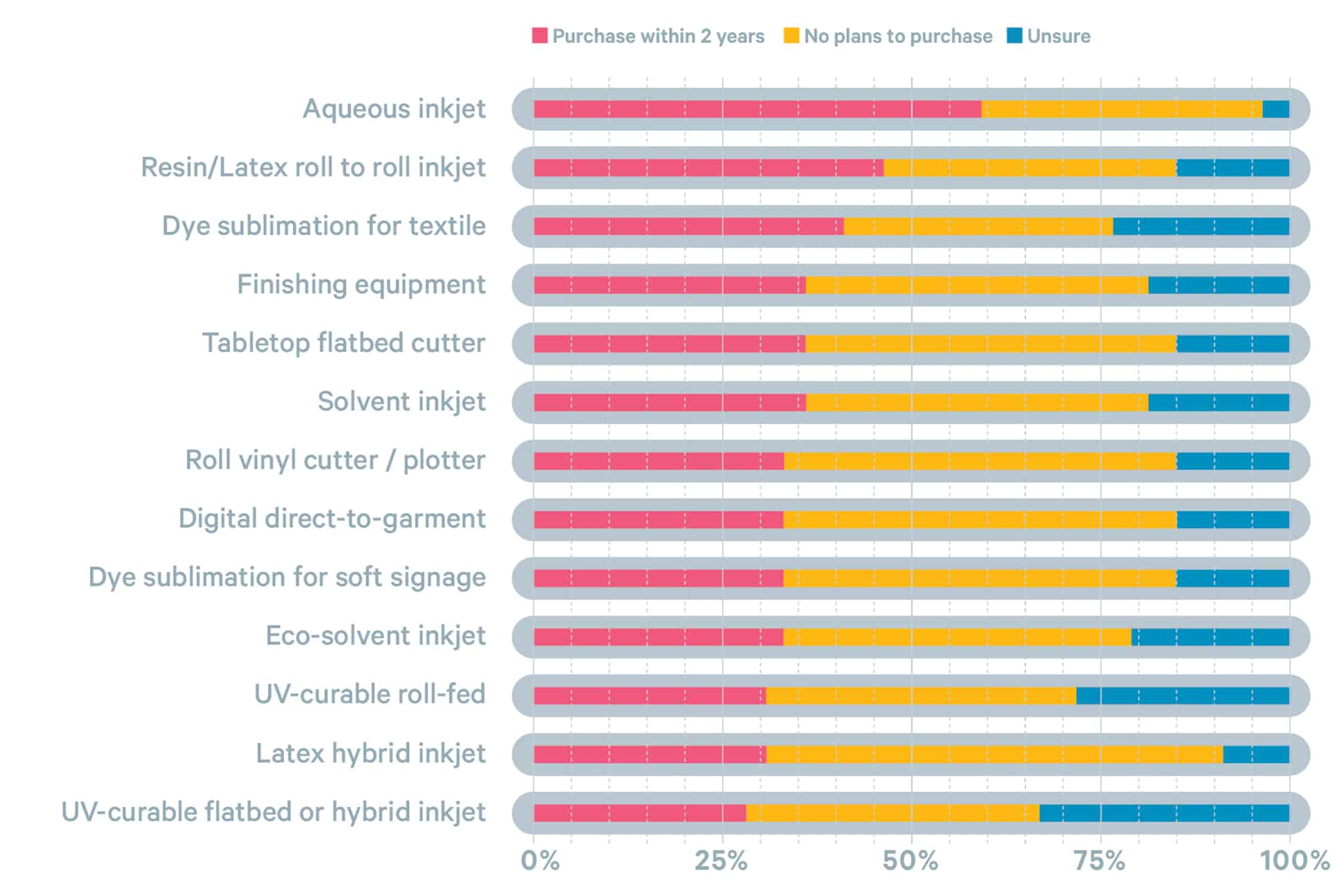

With many survey respondents being commercial printers, we took a compartmentalized look at equipment purchase priorities, comparing the commercial printer that has expanded into wide format to other, more traditional wide-format PSPs, sign shops, and in-house digital print departments.

Commercial Printer Purchase Intent

Traditional Wide-Format PSP Purchase Intent

More than 50 percent of commercial printers said they intend to purchase finishing equipment, resin/latex, or aqueous inkjet within a two-year time projection. As commercial printers continue to expand into wide format, the interest in finishing equipment is a natural progression as they look to provide a complete level of in-house capabilities.

Interestingly, traditional wide-format print service providers, sign shops, and in-house digital print divisions expressed the highest intentions to purchase aqueous devices, followed by resin/latex and dye sublimation within the next few years. Adding an affordable aqueous inkjet device is a wise investment with an increase in volume for fine art/photography and poster print applications. This trend also shows that traditional wide-format PSPs want to diversify their offerings while maintaining a solid GPM.

MISTAKES WILL

HAPPEN,BUT NOT AS

OFTEN AS YOU THINK

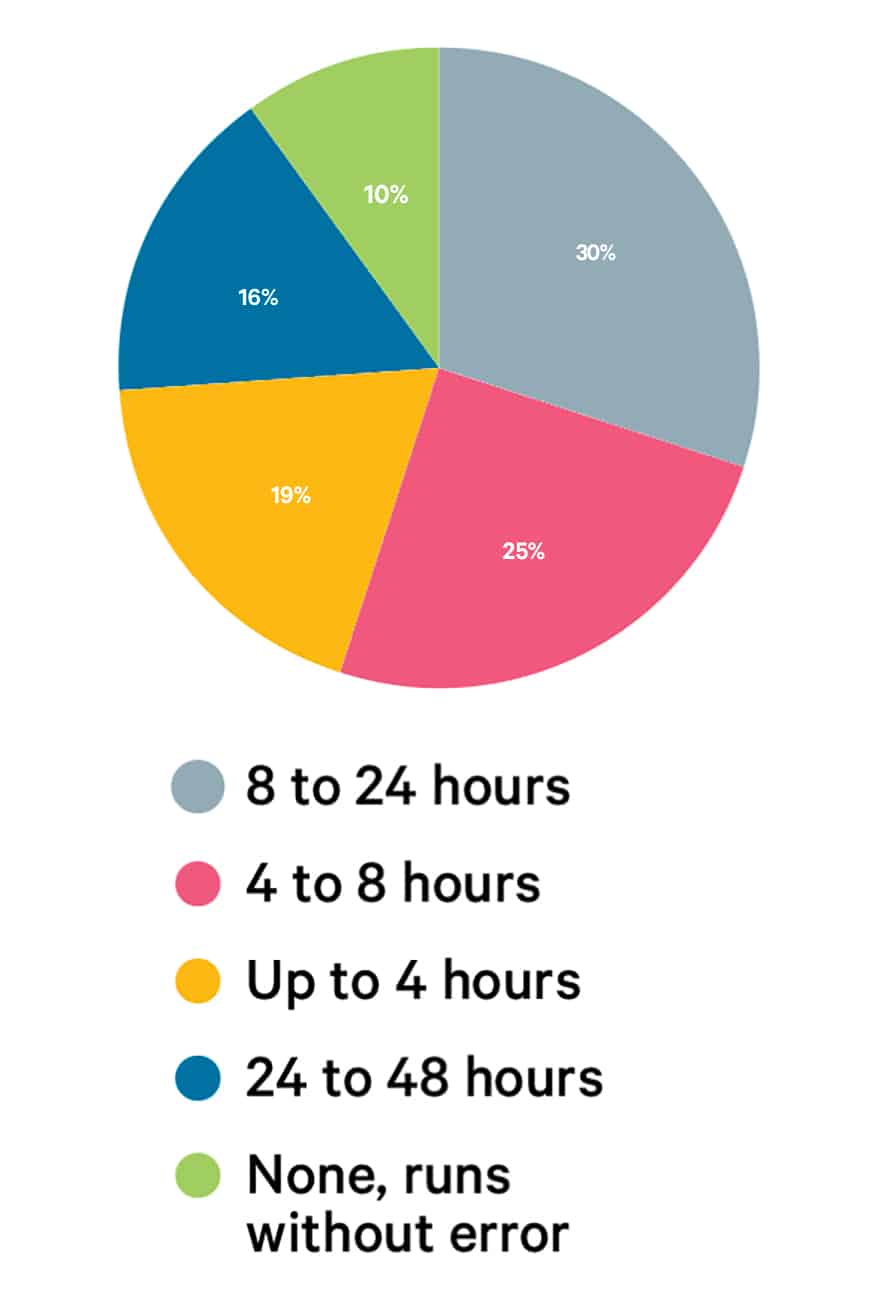

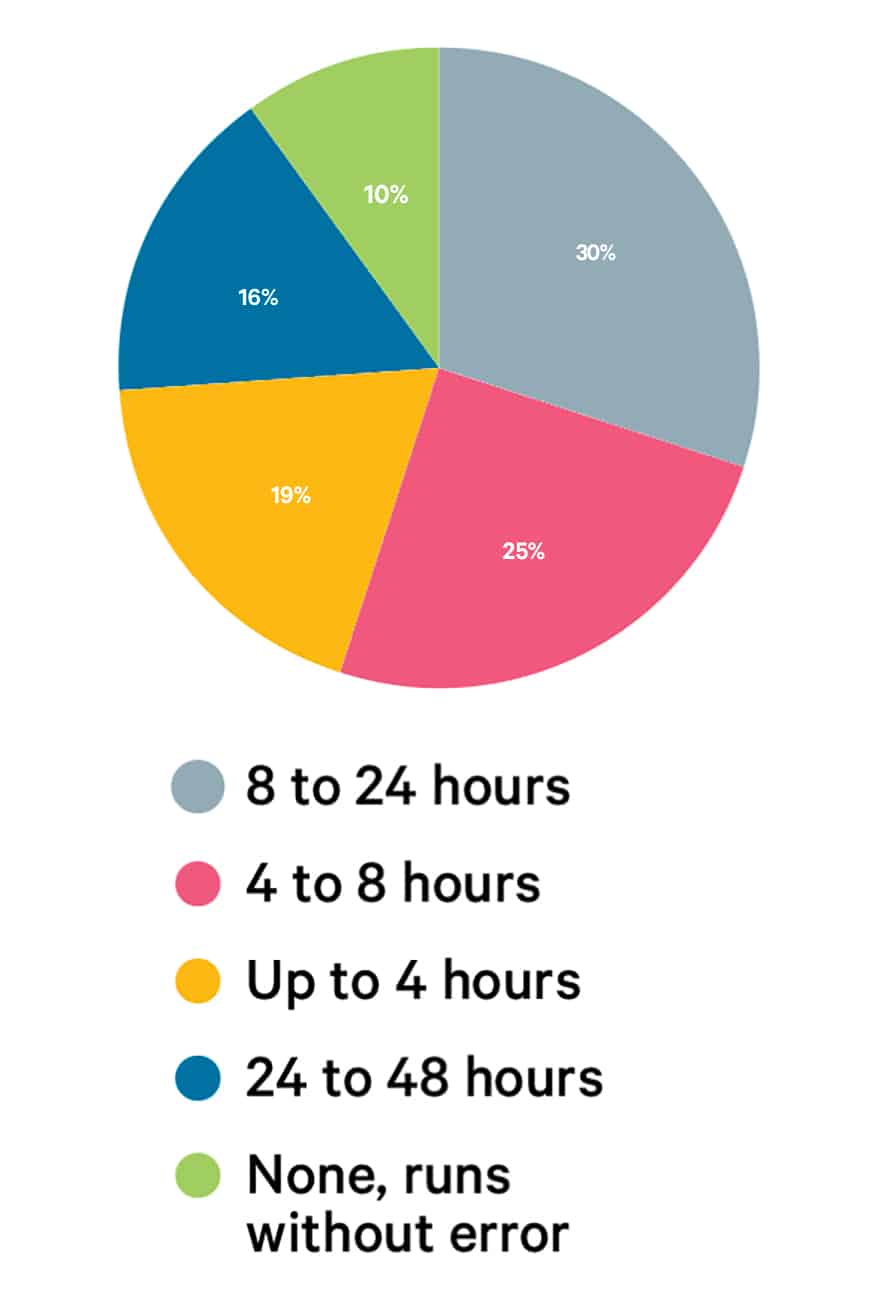

Downtime Due to Mechanical Issues

Production errors are frustrating and often very costly. Even with procedures and approval processes, errors will occur, but not as often as you think.

A robust approval process, requiring customers to sign off on detailed proofs before projects are printed, helps to reduce waste due to material mismatches. When respondents were asked about their customer approval process, 75 percent said the print/design proof was signed by a customer or approved by an associate before printing. Seventeen percent said the customer approval takes place during online ordering, and seven percent had no official approval process.

Even with a signed proof, mistakes will occasionally happen. These errors, often leading to discarded or wasted print work, are mainly attributed to client rejection for specification mismatches (15 percent) and finishing errors (12 percent). That being said, 48 percent of overall errors seldomly happen, 38 percent sometimes happen, and only nine percent, on average, happen often. For time lost due to printer errors every month, the overall error rates are not too time consuming: 87 percent of errors are solved within four hours, 27 percent take 30 to 60 minutes, 24 percent take one to four hours, and just three percent take more than eight hours to resolve.

Mechanical issues with wide-format print devices paint a different picture than specific workflow issues. Device redundancy should be prioritized based on 55 percent of PSPs reporting monthly downtime of 4 to 24 hours and 15 percent reporting 24 to 48 hours. While diversified technology is essential to overall growth, having backup printers in place will help significantly reduce downtime due to mechanical issues.

THE NEED TO OPTIMIZE

WORKFLOW LEADS TO

GROWTH IN AUTOMATION

Automation

Cost Savings Due to Nesting/Ganging

Cost Savings Due to Nesting/Ganging

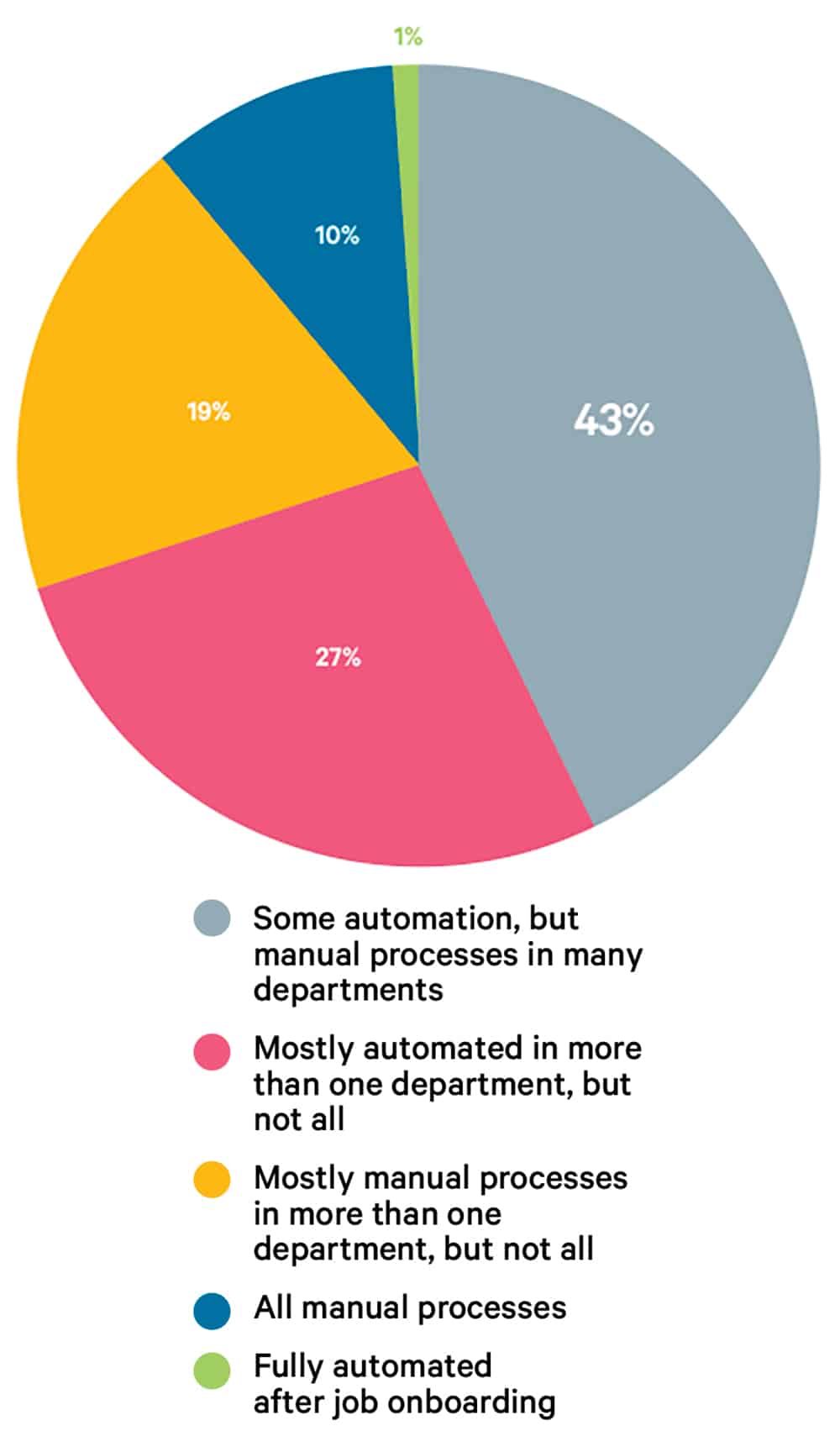

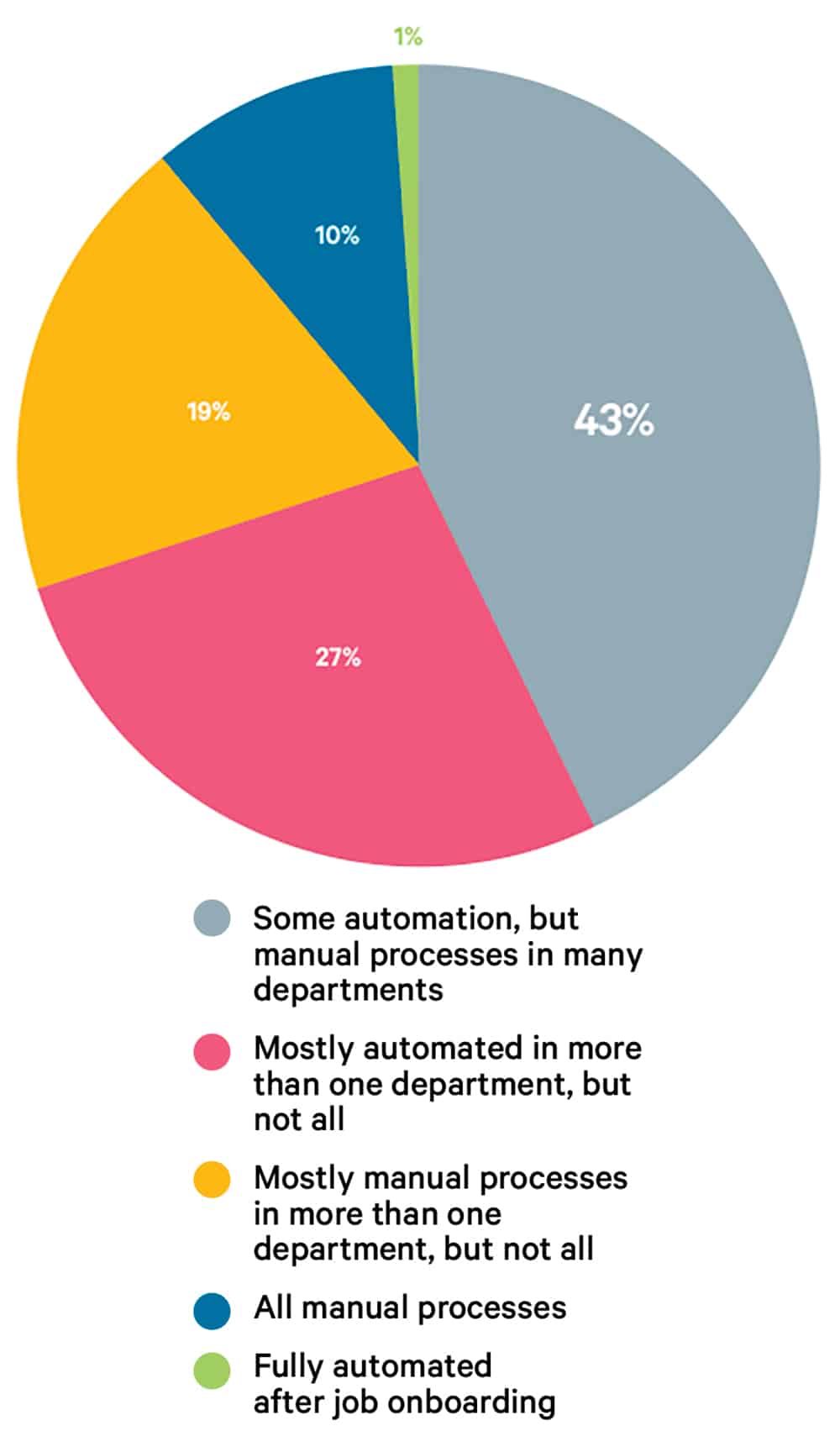

Pre-pandemic, the reality was that most wide-format PSPs were based on manual processes, with few having automated their workflows. With the rise of web-to-print demand, faster turnaround times, and labor shortages, adaptation to automation has increased significantly.

Ninety percent of PSPs currently use some form of automated workflow, while 43 percent use some automation but still run other departments manually. Twenty seven percent are mostly automated, and only one percent are fully automated. We expect this trend to continue as PSPs face the ever-increasing challenge of “doing more with less.”

Waste reduction and workflow streamlining in production have become priorities in software and automation trends, catalyzing a dynamic shift in software ownership.

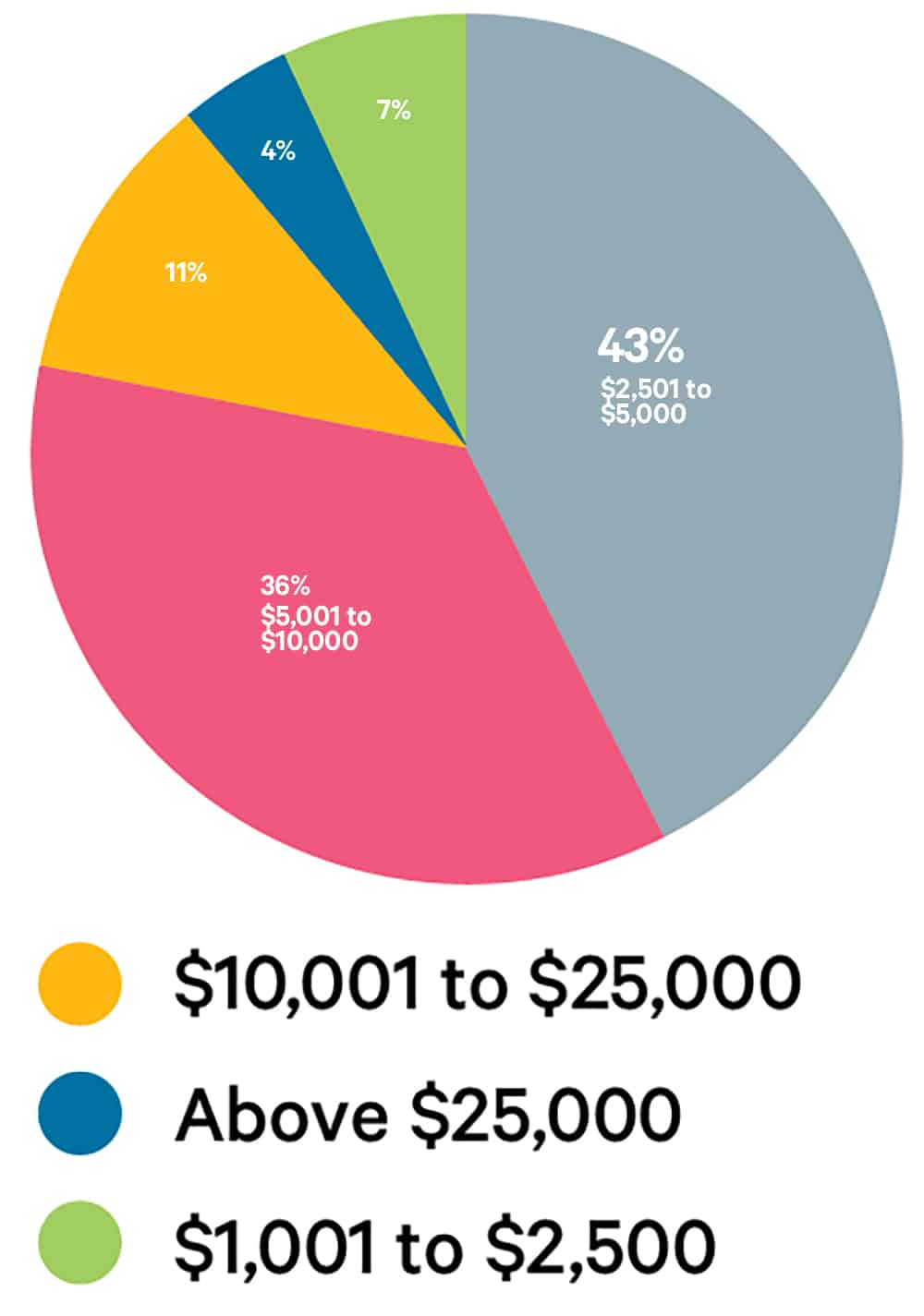

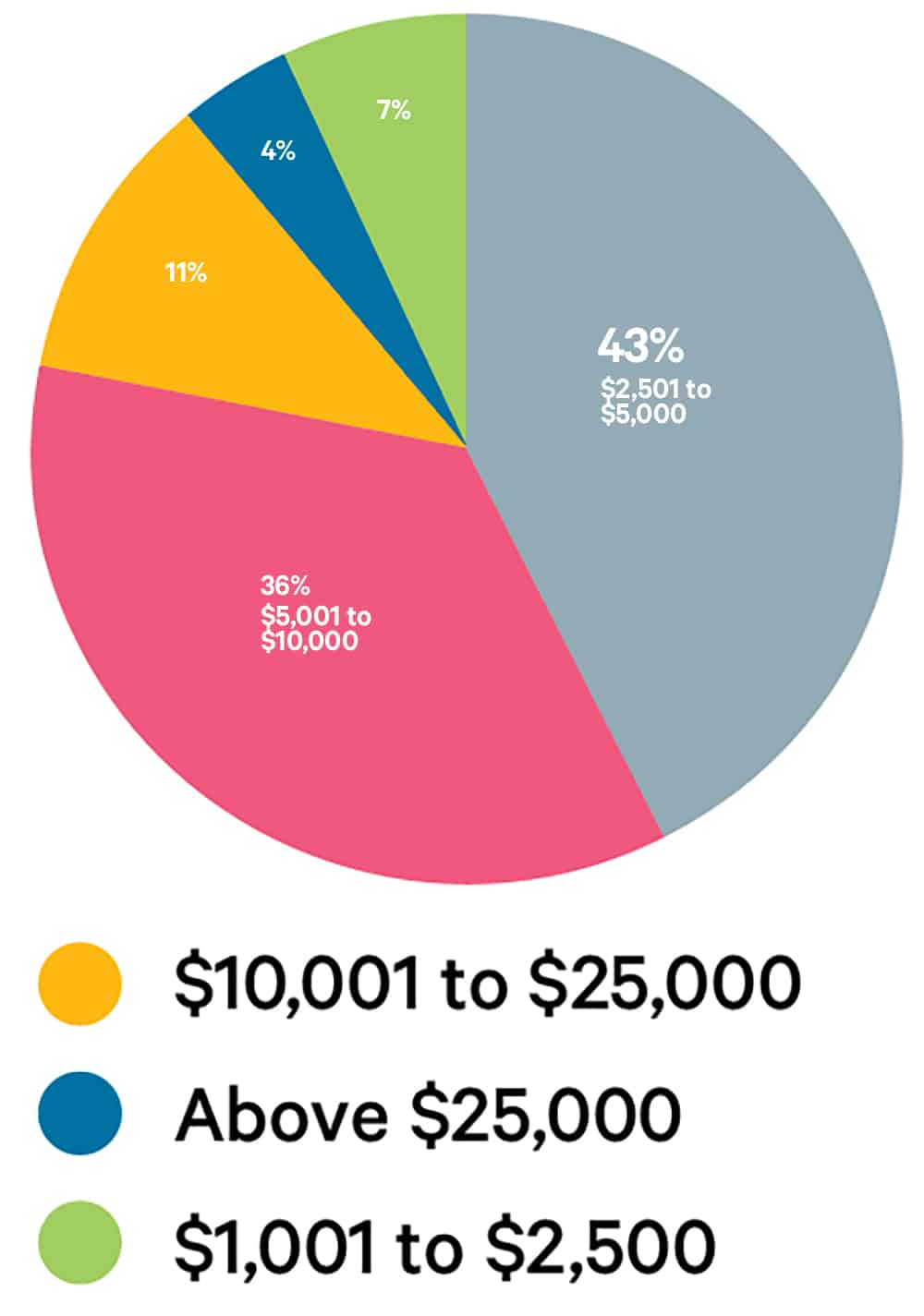

Nesting software ownership has advanced to the fourth most prevalent, with 92 percent of wide-format PSPs actively utilizing nesting and ganging software features to optimize capacity and savings from load management. Annual cost savings gained by optimizing substrate usage with nesting and ganging software show 35 percent of PSPs saving $2500 to $5000 and 29 percent saving $5000 to $10,000.

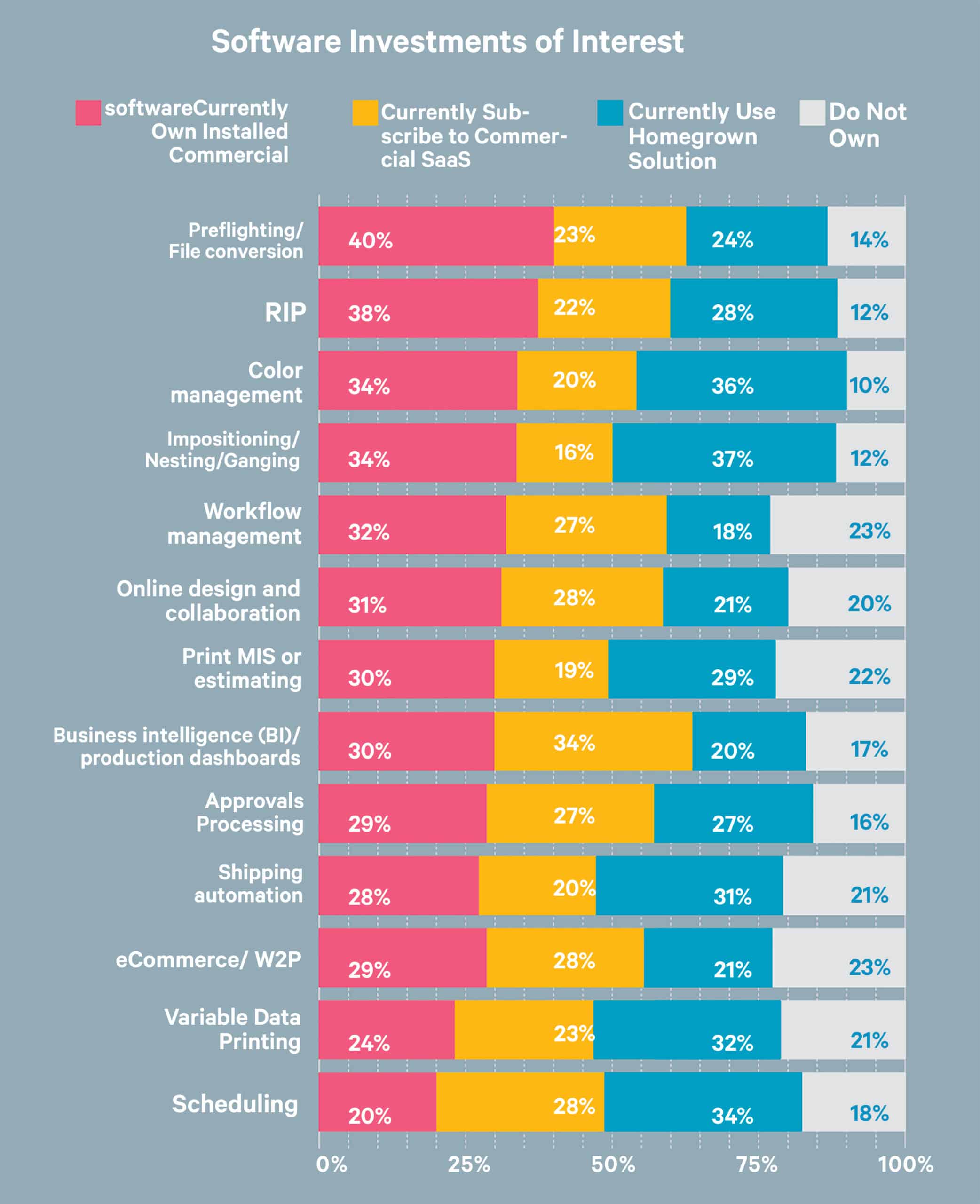

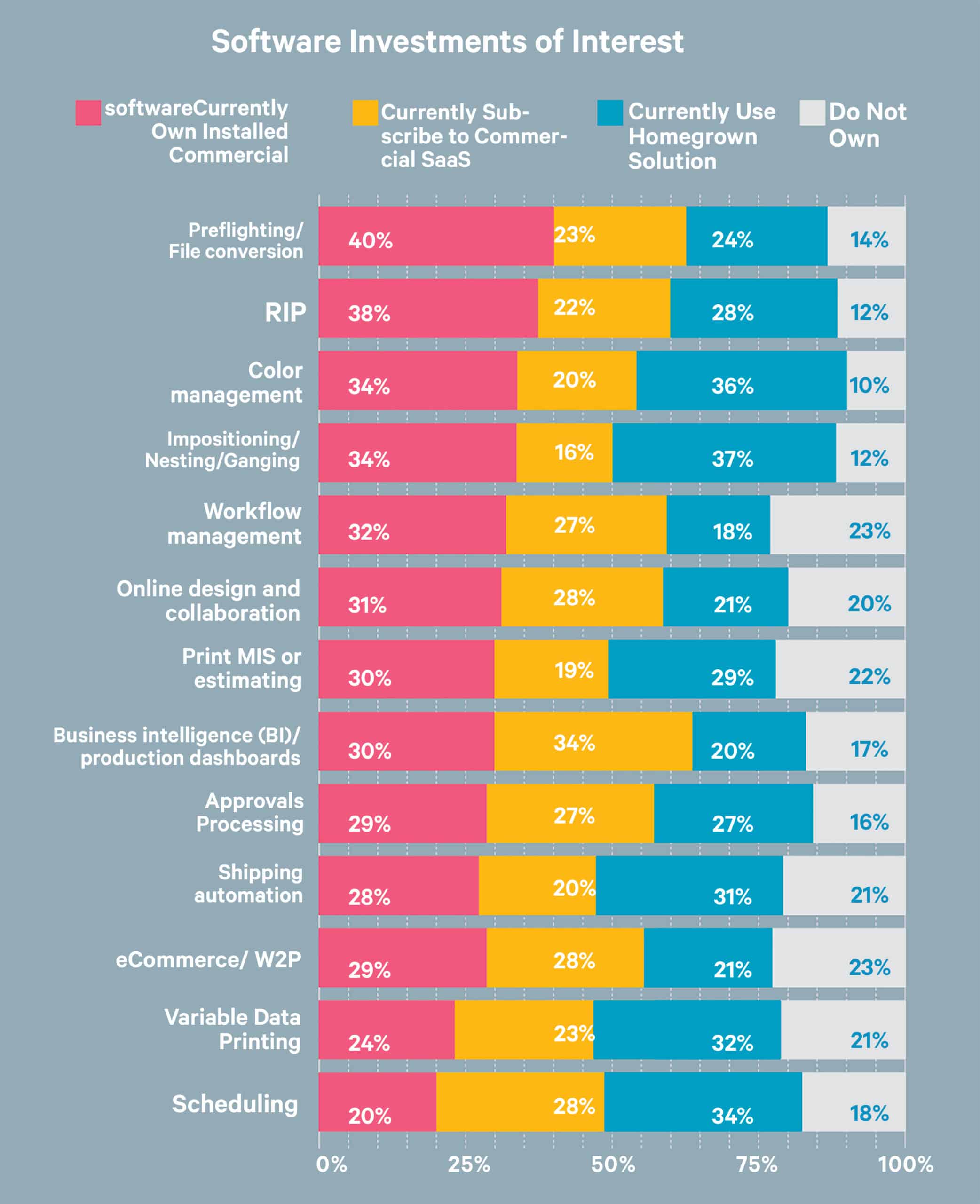

Preflight and file conversion, color management, and approval processes were the top three software investments of interest, with an average of 26 percent of PSPs having a software as a service (SaaS) subscription they plan to renew. Twenty five percent are considering purchasing new software, and 23 percent are considering new subscriptions.

Revenue Expectation for 2022/23

PSPS ARE CAUTIOUSLY

OPTIMISTIC ABOUT

THE FUTURE

Impact of Supply Chain Issues

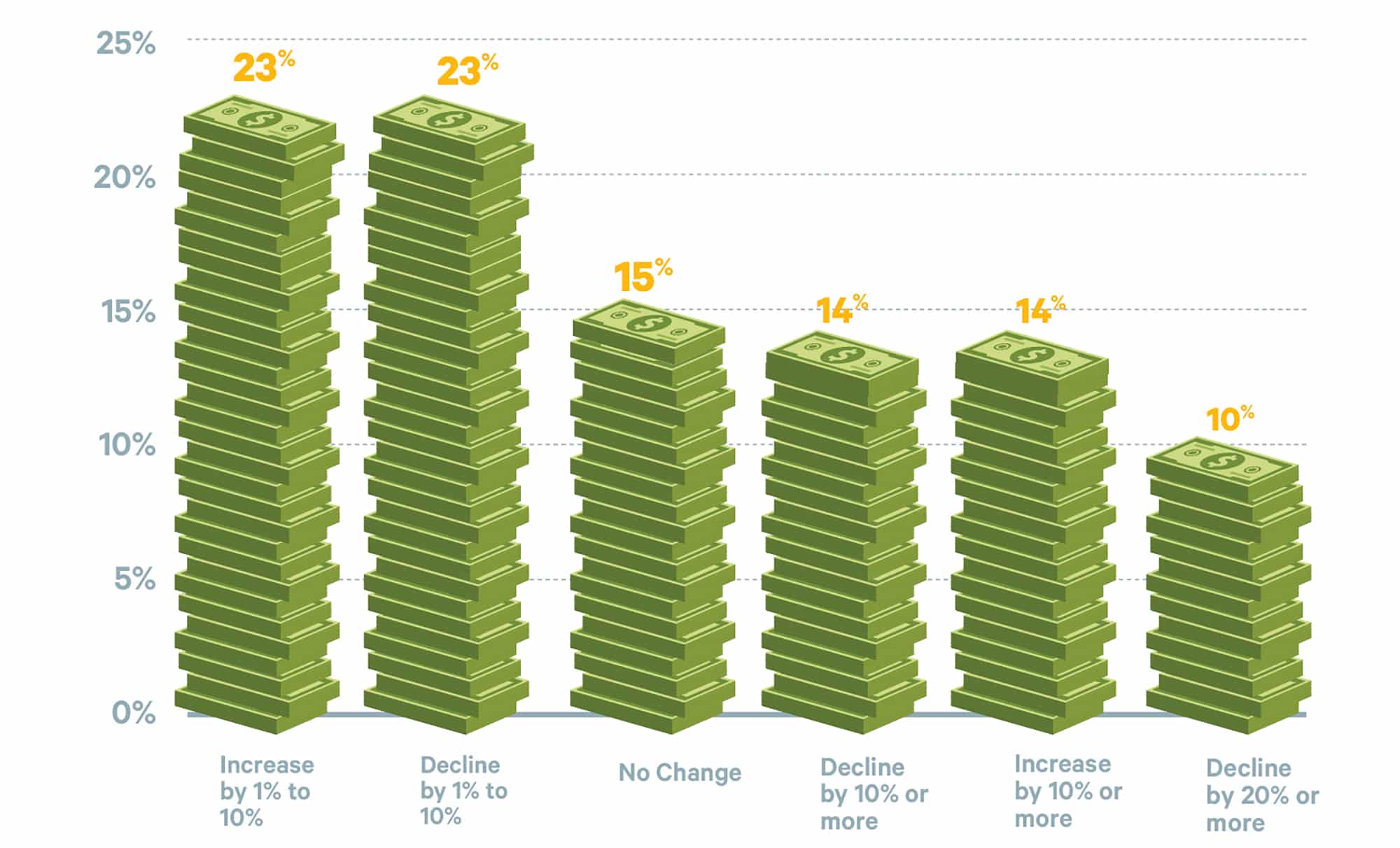

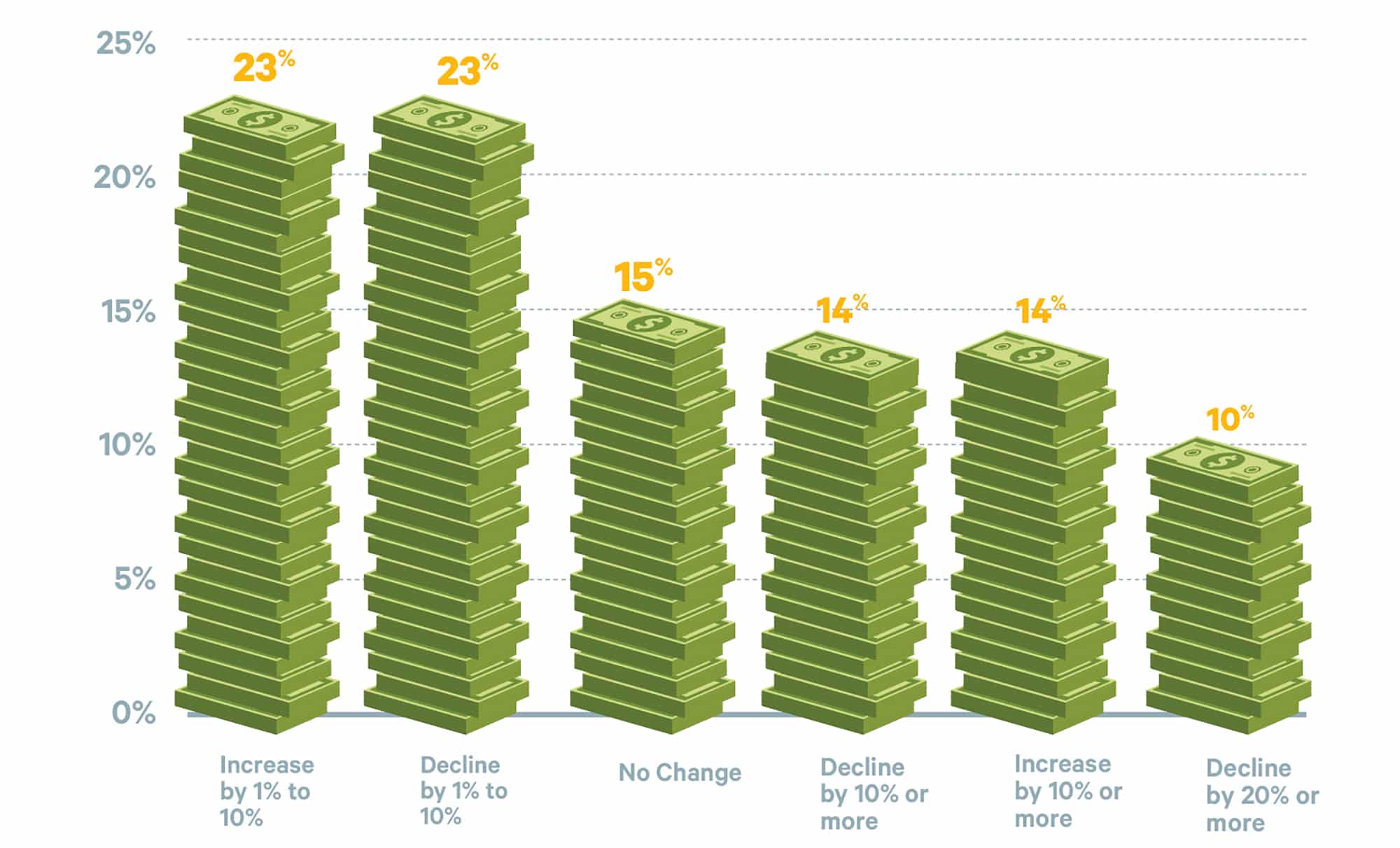

Respondents had mixed answers when asked about revenue expectations for the coming months. With 23 percent of PSPs expecting a revenue increase of up to 10 percent, an even 23 percent felt there would be a decrease of the same amount. Further, while 14 percent expect an increase of 10 percent or more, an equal 14 percent predict a decline of 10 percent or more.

of PSPs currently use some form of automated workflow.

of PSPs currently use some form of automated workflow.

of PSPs only felt minimal delays due to supply chain issues.

of PSPs only felt minimal delays due to supply chain issues.

Labor shortages continue to cause strain, with 64 percent of PSPs reporting they have had employees resign in the last year. Additionally, supply chain issues have impacted deadlines, albeit marginally, with 78 percent of PSPs stating they have felt minimal impact with only limited delays due to supply chain disruption.

While we still have a long road to travel, economic recovery for the wide-format industry is well on its way. The path is not without challenges, but with diverse application capabilities combined with hardware, software, and automation opportunities, wide-format PSPs are well equipped to navigate through recovery and maintain a healthy level of profitability.

VEHICLE WRAPS + GRAPHICS3 weeks ago

VEHICLE WRAPS + GRAPHICS3 weeks ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Case Studies3 weeks ago

Case Studies3 weeks ago

Case Studies1 week ago

Case Studies1 week ago

Press Releases2 months ago

Press Releases2 months ago

Benchmarks3 weeks ago

Benchmarks3 weeks ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Press Releases2 months ago

Press Releases2 months ago

of PSPs currently use some form of automated workflow.

of PSPs currently use some form of automated workflow. of PSPs only felt minimal delays due to supply chain issues.

of PSPs only felt minimal delays due to supply chain issues.