IN APRIL AND JUNE of this year, Big Picture magazine and Keypoint Intelligence conducted surveys of sign shops, commercial printers, and in-plants to gain a perspective on how the industry is coping with the impact of the COVID-19 pandemic. Not surprisingly, the data showed that printing companies were under significant pressure from the initial closure and subsequent efforts to reopen the economy. The survey in April found that printers experienced a 28 percent YOY decline in revenues from January through April. The survey conducted in June found that less than half (46 percent) of printing companies were fully open at full staffing. Big Picture magazine and Keypoint Intelligence once again checked in with the industry from November 13-20, 2020, to see how the printing companies are faring. The current data paint a picture of an industry that continues to struggle and survive.

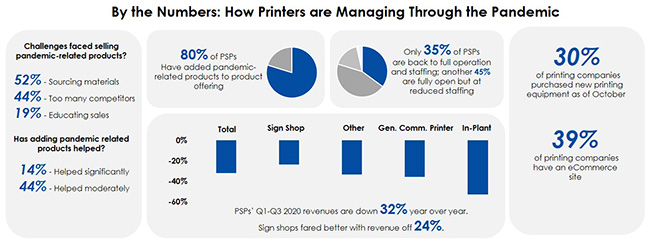

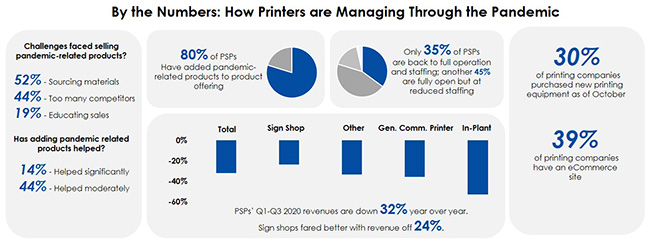

To say that Wall Street and Main Street represent a bifurcated US economy would be an understatement. Unfortunately for the printing industry, the bulk of its customers reside on Main Street. The November 2020 survey found that only 35 percent of printing establishments are fully open at full staffing. Another 45 percent are open, but at reduced staffing. To help mitigate the current challenges, a solid majority of these establishments (80 percent) have introduced pandemic-related products. Although they have experienced some challenges selling these new products, nearly two-thirds of printers selling pandemic-related products indicate that this has helped these companies weather the current economic conditions.

Revenues for the first three quarters this year are expected to be down 32 percent overall. Sign shops, which have benefited from demand for COVID-19 related signage, fared better. Their revenues are expected to decline 24 percent; still a painful decline, but not as bad as the broader printing industry. Surprisingly, printing establishments with e-commerce platforms did not necessarily fare better, which seems counterintuitive given that consumers and businesses alike are buying everything from carrots to cars and cryptocurrencies online at a rapacious rate during this pandemic. Less surprisingly, the percentage of printing establishments purchasing equipment is only 30 percent.

Nevertheless, the industry is surviving. Less than 3 percent of respondents indicated they are in the process of closing their business. Cuts in staffing and branching out into new pandemic-related products appears to be helping keep the doors open for now. Moreover, as challenging as the current economic conditions are, the economy has been improving. However, the rate of improvement is not going to be fast enough for many printing establishments. More than one-third of them (36 percent) will not see an economic recovery until the second half of 2021, and nearly another third will not see a recovery coming until 2022.

Advertisement

This would explain why 69 percent of printing establishments think it is important for the federal government to pass an economic stimulus plan, and most agree this should be done as soon as possible. That, of course, requires Congress to negotiate an agreement on the size and shape of any new stimulus package. This reminds me of a joke. Three economists entered a Zoom meeting to come to an agreement on the current state of the economy. I suspect you can already guess where the punchline is heading…

Hades has a better chance of freezing over than economists, like Congress, coming to a negotiated agreement. Nevertheless, the optimists among us may see hope in the severe cold front currently barreling down on regions of the US that are in the midst of a COVID-19 induced inferno.

Subscribers to our Wide Format Printing service in the InfoCenter, stay tuned for the full report!

Get Caught Up

Coronavirus Versus the $2.2 Trillion Cares Act

How the Printing Industry Is Surviving the Pandemic

VEHICLE WRAPS + GRAPHICS3 weeks ago

VEHICLE WRAPS + GRAPHICS3 weeks ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Case Studies3 weeks ago

Case Studies3 weeks ago

Case Studies1 week ago

Case Studies1 week ago

Benchmarks3 weeks ago

Benchmarks3 weeks ago

Press Releases2 months ago

Press Releases2 months ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Press Releases2 months ago

Press Releases2 months ago