A SHIFT IS UNDERWAY for sign and display graphics producers that will force a change in strategy and operations. As more capable printing equipment is placed, the industry’s production capacity increases. In the world of economics, the increase in supply will negatively impact the price consumers are willing to pay. Pricing pressures are likely to erode profit margins and force sign shops to drive costs out of the operation. Outside of materials, labor is often the highest variable cost that can be augmented and offset by increasing levels of automation.

The good news is there are lessons that can be learned from other segments of printing that have already gone through this shift. Commercial printers, whose primary focus is typically document-based applications, had to pivot their businesses through the introduction of digital printing devices and the disruption of online communications. The result is many commercial printers have continued to expand the range of products and services to target new vertical markets that expanded the use of multiple printing technologies. The expanded production complexity – coupled with the increase in average number of orders (now averaging almost 4000 per month in the US compared to 613 for sign shops) – forces automation to enter the production processes. At a point, throwing additional staff at tasks becomes impractical, not to mention costly, when margins are often in the single digits for commercial printers.

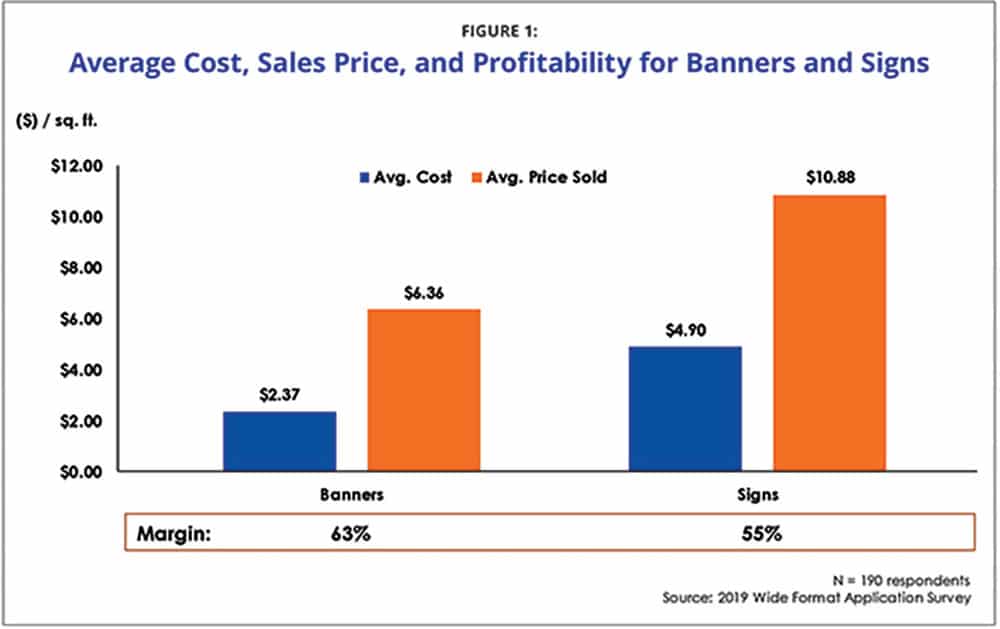

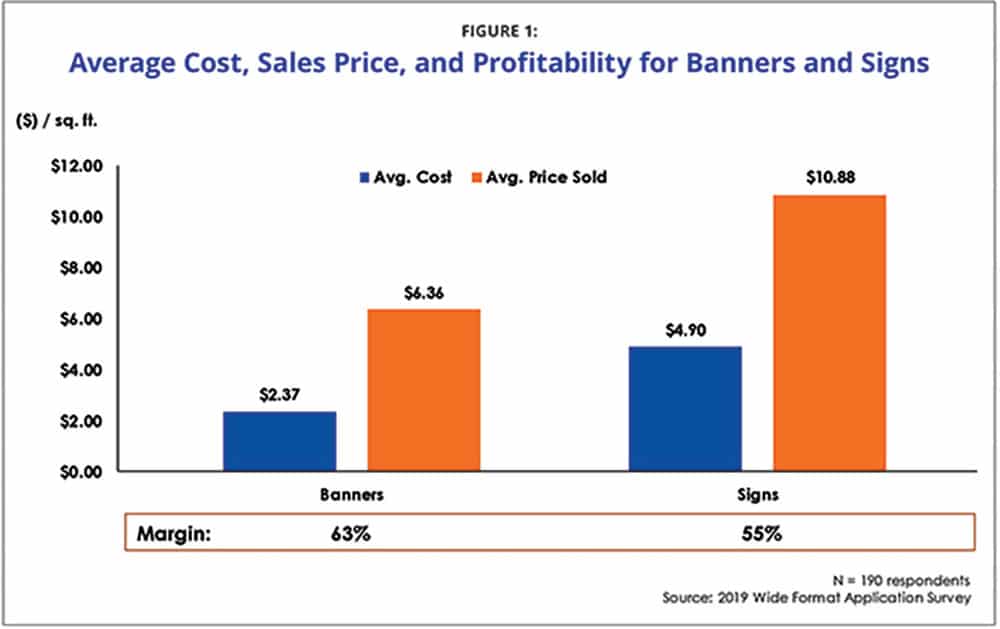

Sign and display shops, in comparison, still have healthy margins for the top two applications – between 55 percent and 63 percent, according to recent research conducted by Big Picture and Keypoint Intelligence. (See figure 1.) Higher margins can result in complacency to keep the same manually intensive production processes in place, thinking the good times will continue to roll. Now is the time to start building automation into your production workflows to succeed in the shift.

Today’s Big Workflow Challenges

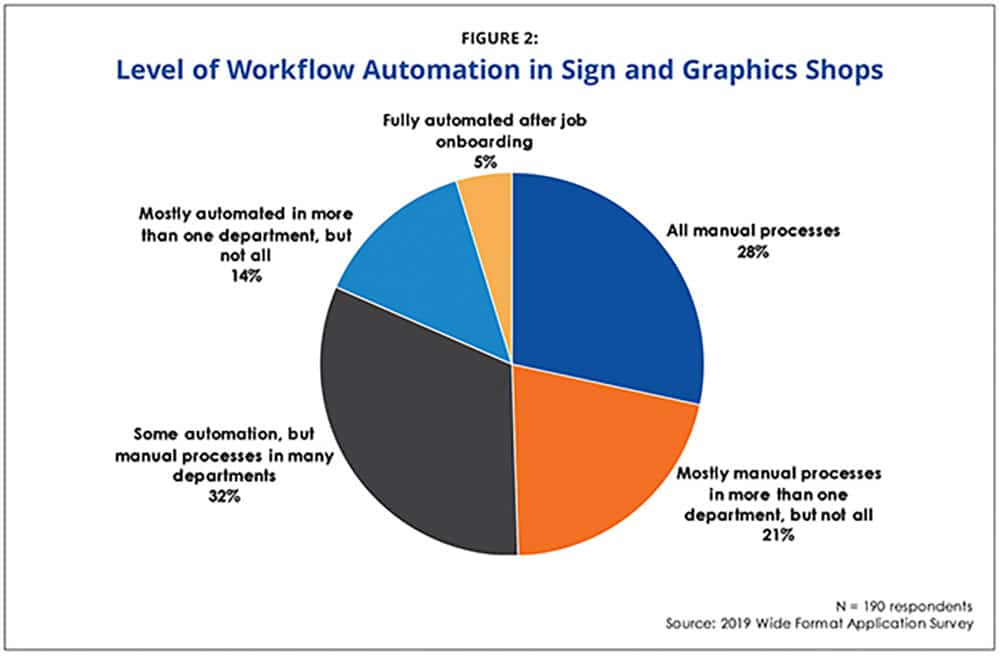

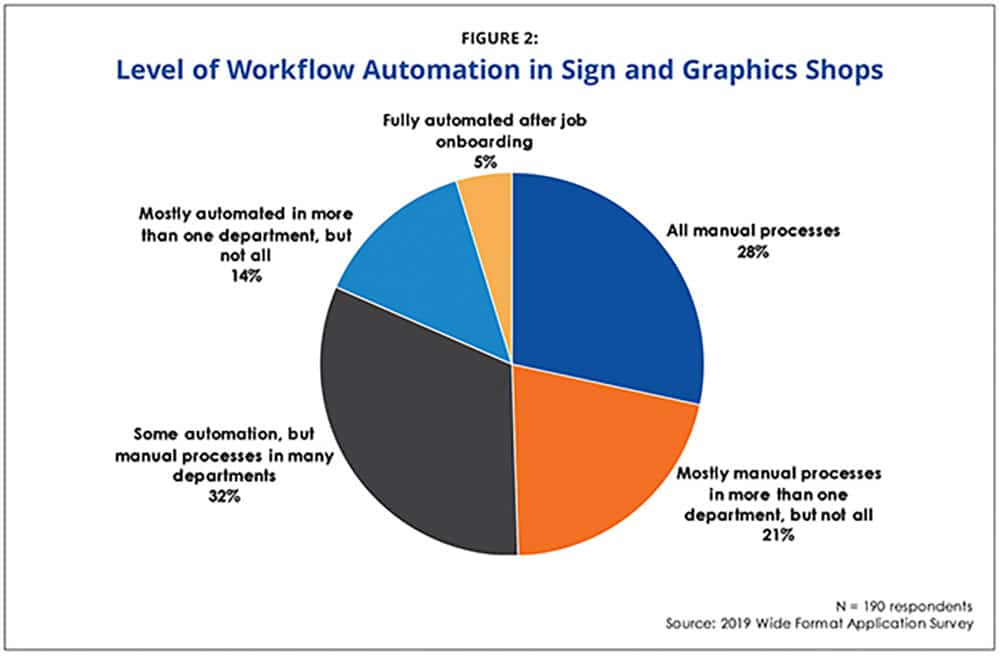

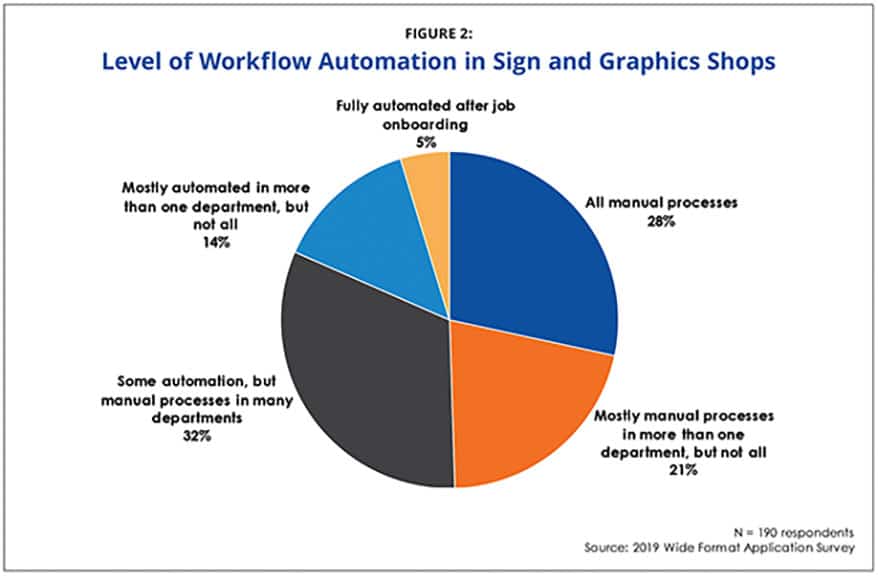

The reality is most sign and graphics shops are based on manual processes with few having automated their production workflows. In fact, research found almost half (49 percent) of respondents had mostly or completely manual processes. (See figure 2.) Customer requests are likely sent through email, manually quoted, and then a job ticket is created once it’s accepted by the customer. The job ticket carries instructions from department to department, with each operator manually adding comments, instructions, and production counts. The artwork may be inspected in prepress, but many tasks like tiling/nesting are commonly performed at the RIP by the printer operator. These manual processes start to crack, then break as the number of orders increase.

Advertisement

There are three critical areas that need software and workflow automation to streamline production: Job onboarding, a single system of record, and a single view of operations. Today, customers can order and submit artwork through many methods from email, which is the most popular, to online storefronts (web-to-print). Job onboarding needs structure to capture the critical information required to produce the work according to the customer’s specifications. Receiving orders through email is anything but structured because the information provided is at the discretion of the client. This forces customer support representatives (CSRs) or other staff to waste time tracking down missing information, such as quantities, due dates, materials, and shipping instructions.

Many sign shops are also lacking a single system of record: A system to track and monitor all customer details and orders. A single system of record acts as the brain and central clearing house for work as it comes in and leaves the shop. It’s also the foundation for providing accurate information to other processes like scheduling and shipping. A print management information system (Print MIS) often fills this role, but they’re not widely adopted by sign shops (only 38 percent own a commercially available solution). There are several vendors that developed wide-format-specific Print MIS solutions, and some offer cloud-based subscriptions at affordable price points.

Finally, too much time is spent in shops setting production schedules and physically tracking the status of work as it moves through each department. Shops need a single view of operations that provides operators with daily work to-do lists, tracks and displays the progression of all work-in-progress jobs, and offers customizable dashboards to view production data (including production capacity). Production dashboards are valuable tools for production managers when work does not go as originally planned – a daily occurrence for most shops. These tools also provide awareness to all shop staff, particularly customer service representatives (CSRs), so that any job can quickly be located and modified when customer’s inevitably have an inquiry or need a change.

Print MIS solutions and RIPs increasingly offer some type of production dashboards. Because most sign shops lack a commercial Print MIS, that leaves the RIP as the source; however, these may only provide machine-specific data and omit job information for all of production.

Where RIPs Excel Today

Workflows in the sign and display graphics segment are largely RIP-based. RIPs are the most owned software (82 percent) for sign shops and perform most of the file preparation tasks. The primary purpose of RIPs is to convert artwork into data and instructions so the printer can produce an image.

Over the years, the functionality has increased where vendors may have added support for:

Advertisement

- Queue/job management

- Preflight (file checking)

- Color corrections

- Imposition

- Color management via ICC profiles

- Cloud-based synchronization

- Production dashboards

One of the more recent developments is the ability to create advanced ganging where multiple jobs can be combined, or even nested, to minimize material usage. The research revealed the majority (72 percent) of respondents are using software to combine multiple jobs for production and average around $7000 in savings annually. (See Figure 3.)

Where RIPs Fall Apart (So Far)

The difficulty of having a RIP-centric workflow is most RIP solutions on the market today do not address the biggest workflow issues of job onboarding, a single system of record, and a single view of operations.

In fairness, RIP vendors have been expanding their solutions to support more workflow tasks. Several have modules or options to accept orders from web shops or onboard jobs through online file transfer tools like Box and Dropbox, which are far better than using email. Some vendors also can integrate through an application programming interface (API) or connectors with other software solutions, such as Print MIS and prepress workflow automation tools. Fewer still have created production dashboards. These largely focus on collecting data from connected equipment, such as print volumes and ink consumption, and cannot provide a view for all production activity.

The Way Forward

Sign shops must go beyond the RIP to build automation into their operations. While RIPs are critical to digital printing and continue to expand their feature sets, there are other solutions better suited to be the eyes and brains of the operation – specifically production dashboards and Print MIS solutions.

When these software solutions are used together, shops fix the big workflow challenges and gain the efficiency and cost benefits of automation. How are you preparing for the industry shift?

VEHICLE WRAPS + GRAPHICS3 weeks ago

VEHICLE WRAPS + GRAPHICS3 weeks ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Case Studies3 weeks ago

Case Studies3 weeks ago

Case Studies1 week ago

Case Studies1 week ago

Benchmarks3 weeks ago

Benchmarks3 weeks ago

Press Releases2 months ago

Press Releases2 months ago

Press Releases3 weeks ago

Press Releases3 weeks ago

Press Releases2 months ago

Press Releases2 months ago