IN TODAY’S WIDE-FORMAT printing industry, profitability and efficiency are top priorities for print service providers (PSPs). As technologies advance and customer demands shift, the landscape of wide-format printing has seen significant changes.

In collaboration with Keypoint Intelligence, Big Picture magazine completed a web-based survey of owners and employees of wide-format PSPs to illustrate the latest trends in application profitability, equipment investments, error reduction, and the growing demand for automation. The survey offers insights into how PSPs can continue to grow and thrive in a competitive market.

Let’s look at the key findings of this survey to learn firsthand what PSPs are doing to maintain profitability and gain market share in a challenging economy.

Profitability Is on the Rise but

There Is Still Room for More

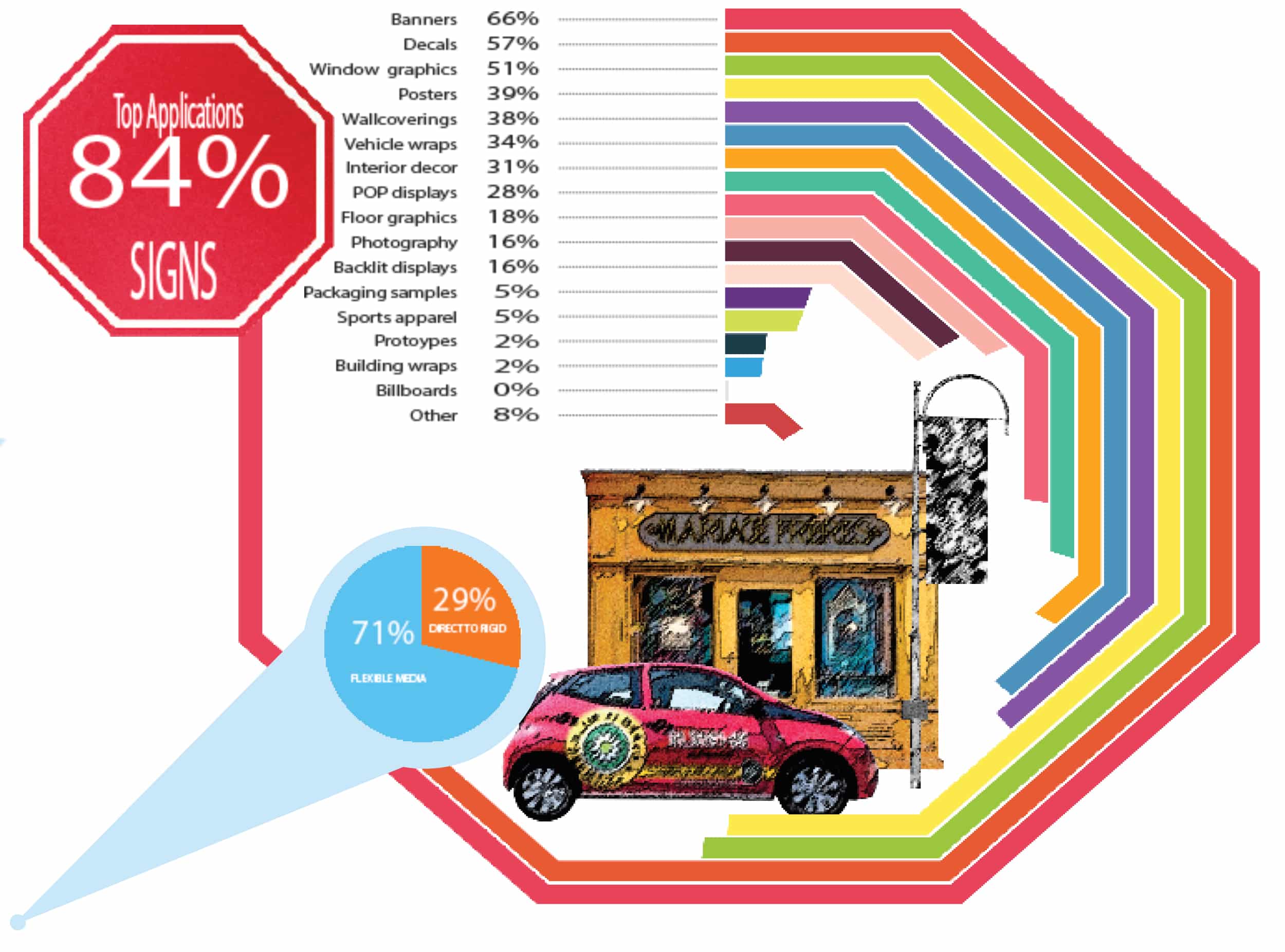

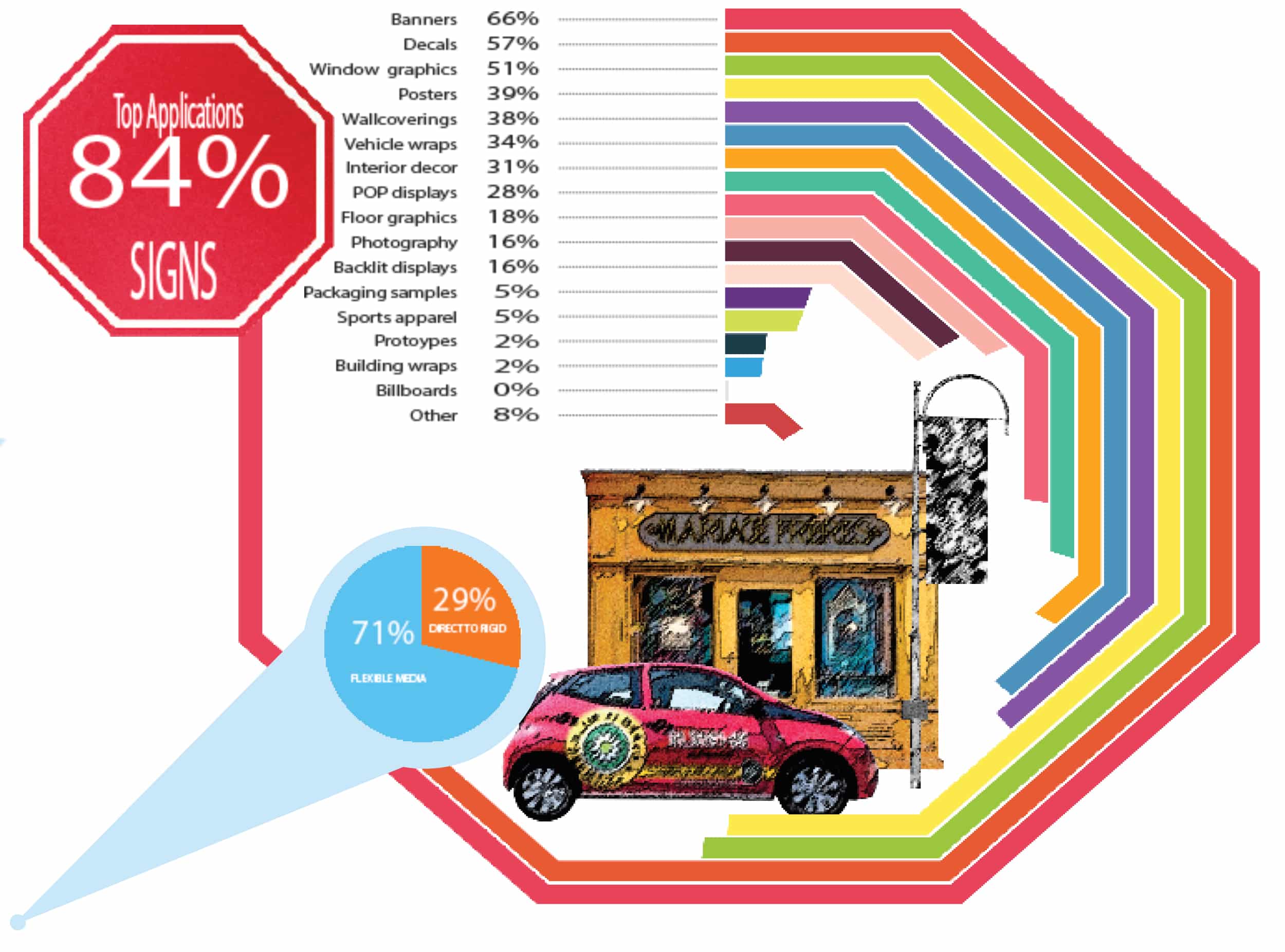

In response to which top five wide-format print applications represented the highest average monthly print volumes, banners, decals, and signs — as in years past — remain at the top of the rankings. To round out the top five list of most produced applications, we saw an increase in window graphics and poster printing.

With a 71% share of volume, it comes as no surprise that seven out of the top 10 applications are all printed to flexible substrates.

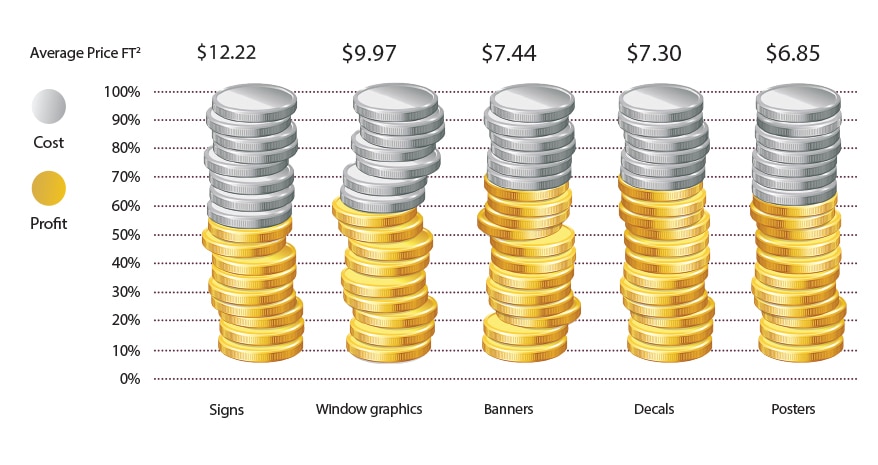

Profit Breakdown

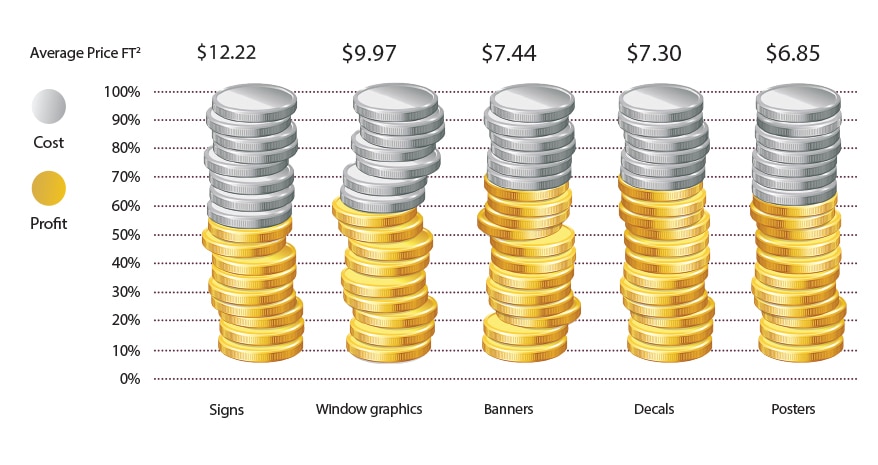

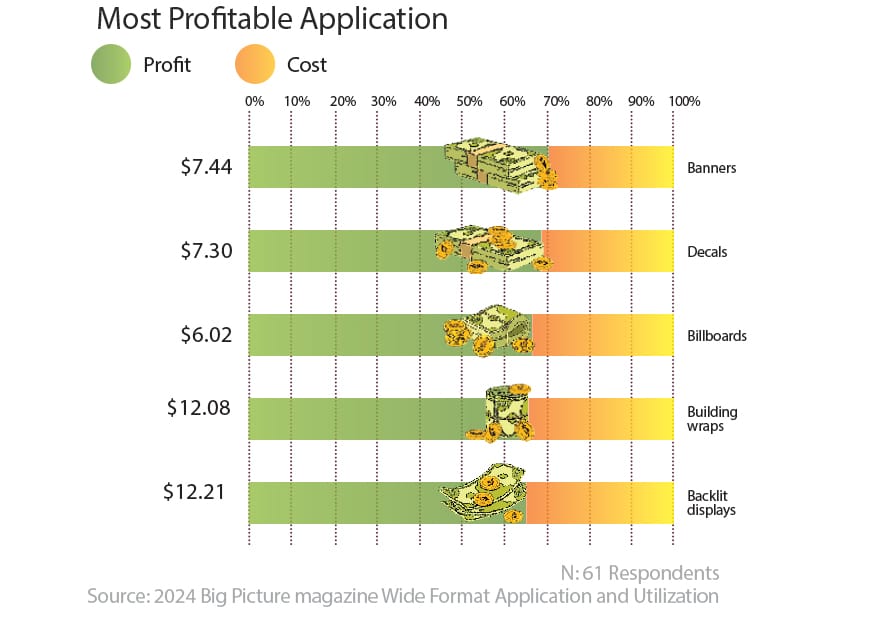

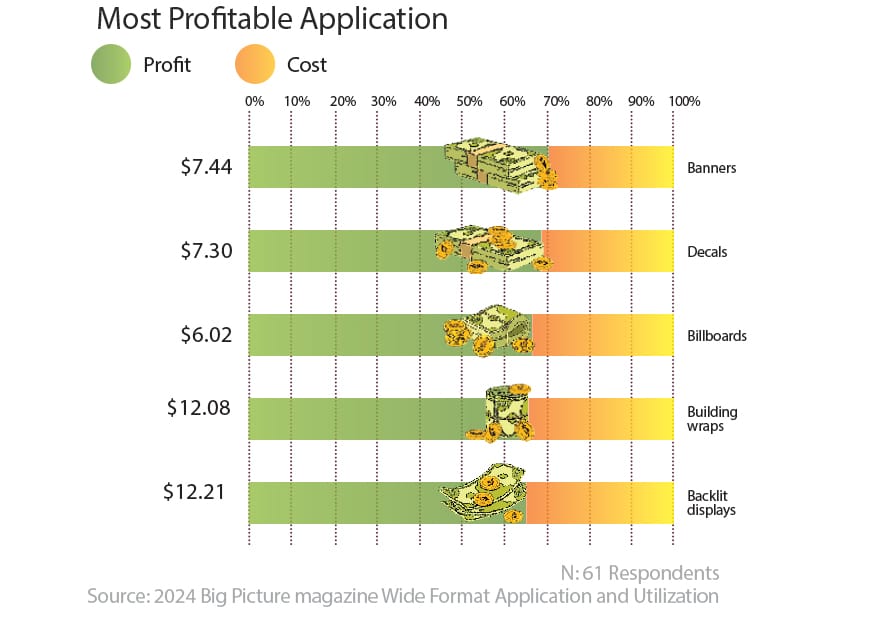

Banners maintained the highest volume ranking while producing a 69% gross profit margin (GPM), only to be matched by decals with the same GPM. While all the top five leading applications all show above 56% GPM. Other, less frequently produced applications, proved more profitable.

Following banners and decals at 69%, billboards at 66%, building wraps and backlit displays at 65%, all produced more profit than the other top five higher-volume applications. While profit margins have rebounded significantly from the recovery period of the past few years, it is important for PSPs to guide their sales and marketing strategies toward the most profitable applications.

Equipment Trends Are Driven

by Workflow Optimization

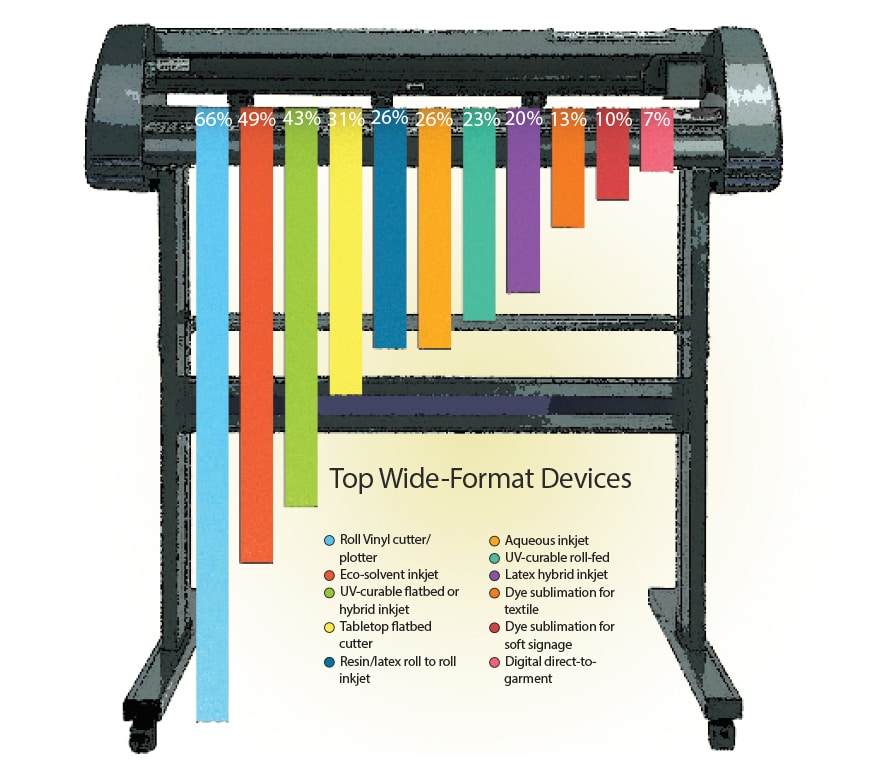

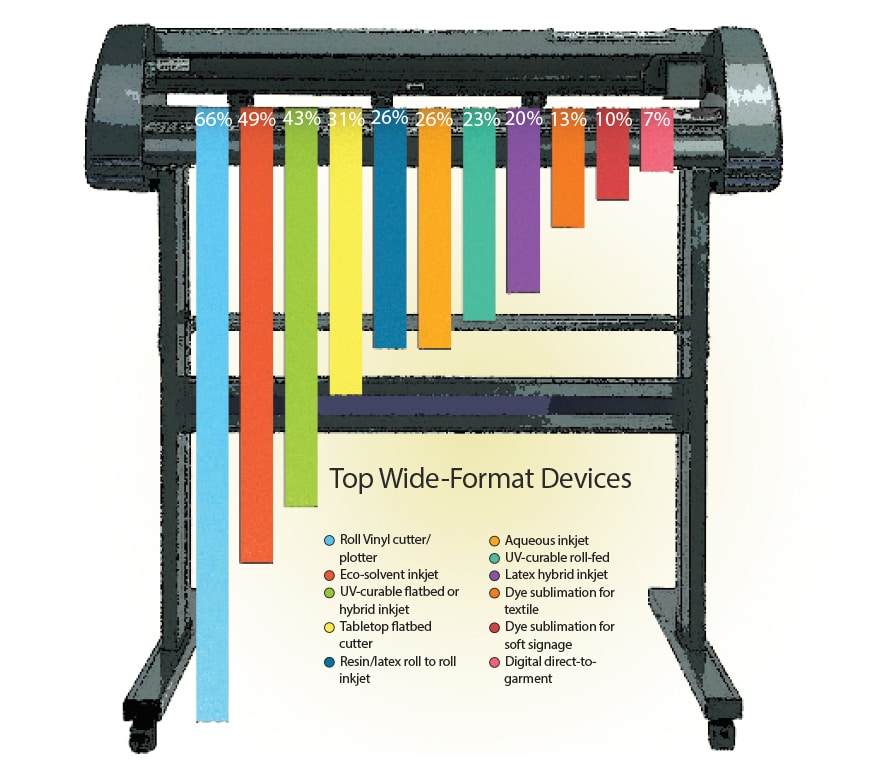

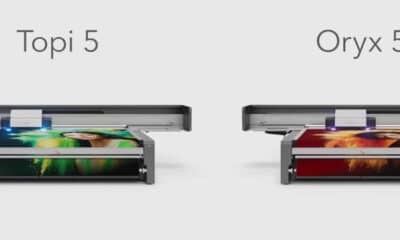

Most PSPs currently own a variety of wide-format printing equipment providing the capability to produce a diverse list of applications from traditional signage and graphics products to customized direct-to-object and direct-to-garment (DTG) printing.

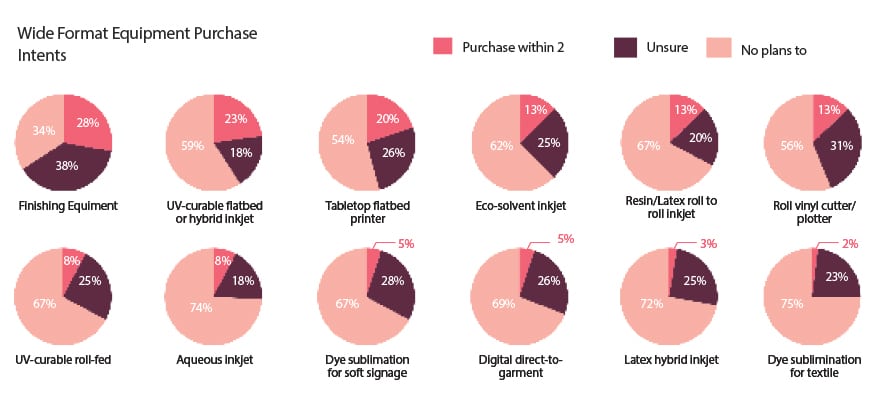

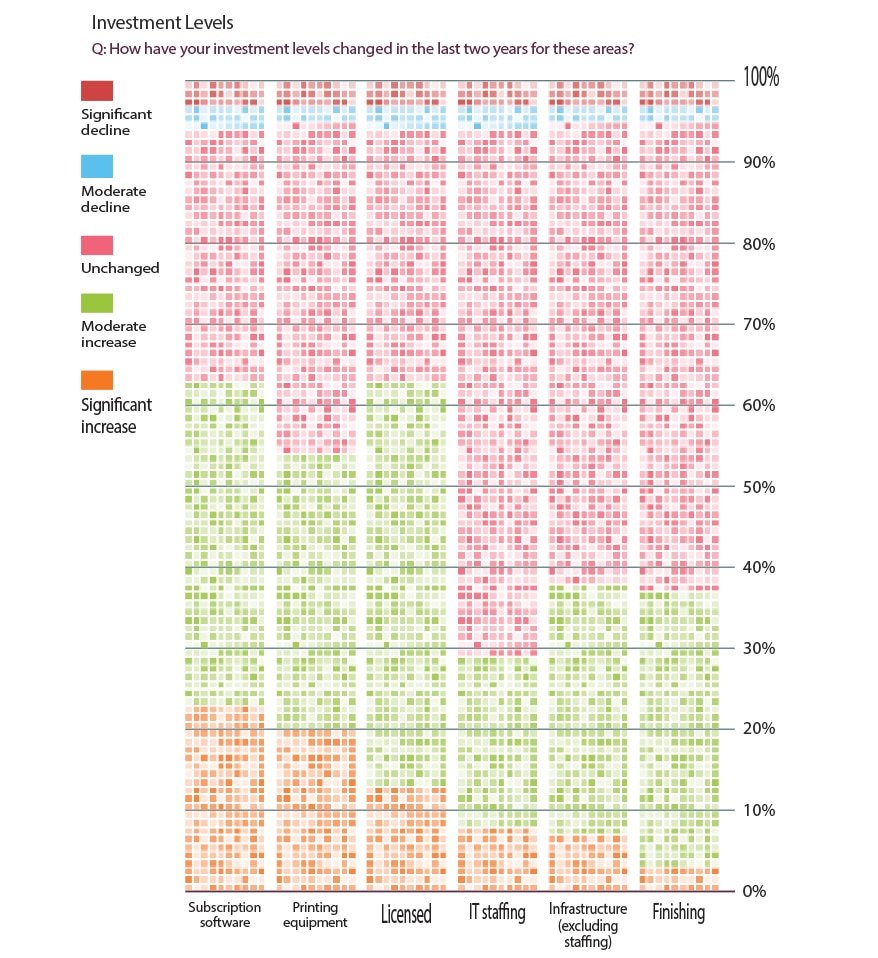

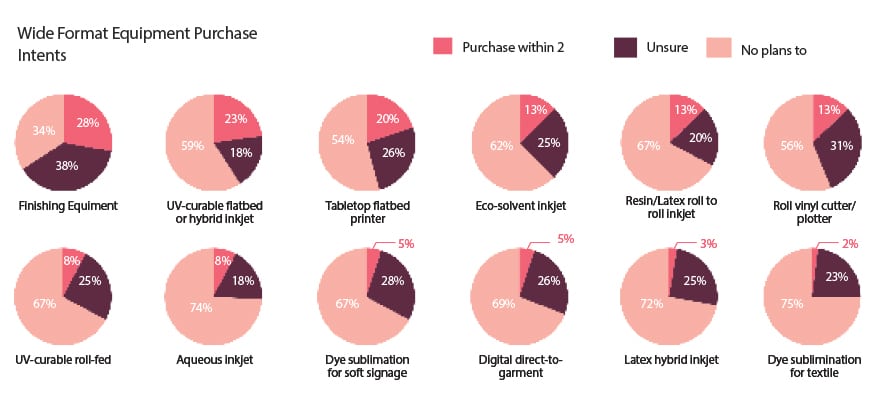

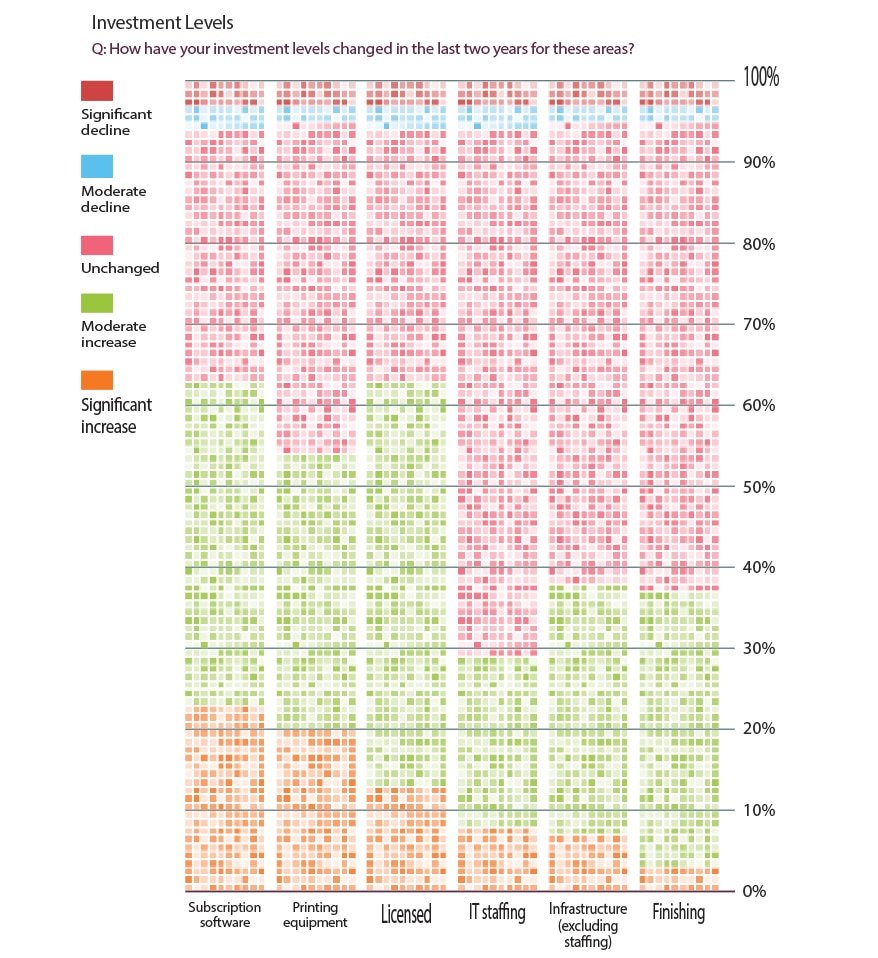

However, even with GPMs on a healthy rise, investment interests seem to be fairly cautious. Of those interested in purchasing new equipment within the next 24 months, 28% are interested in finishing equipment, showing a strong interest in optimizing complete, in-house workflow solutions over increasing throughput.

With capital expenditure budgets being carefully spent, 43% of PSPs are considering investments in UV direct-to-object devices that offer a way to maximize application opportunities and streamline production by reducing the number of steps involved in the printing process.

Error Reduction:

a Positive Trend

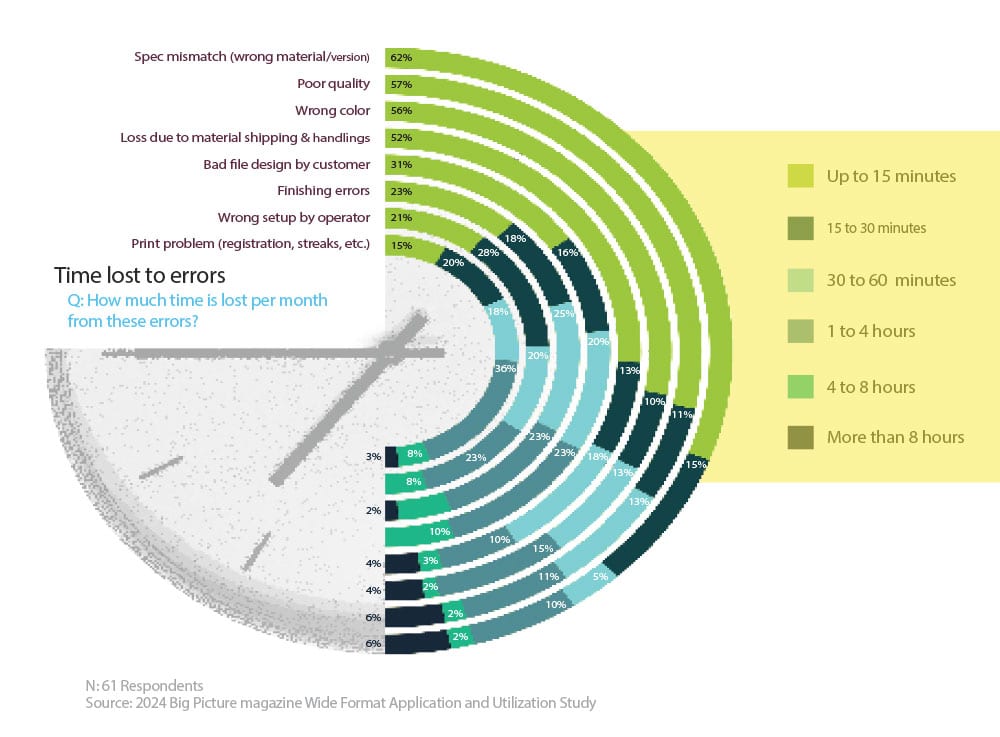

Production errors can be both frustrating and costly. Despite having procedures and approval processes in place, mistakes will still happen—though not as often as expected. A strong approval system, where customers sign off on detailed proofs before printing, helps minimize waste caused by material mismatches.

When respondents were asked about their customer approval process, we have found a shift from PSPs receiving a signed print/design proof 62% (down from 75% in 2022) to 23% (up from 17%) getting customer approval during online ordering. This is a promising result showing digital workflows continuing to gain interest.

We fully expect this to continue and accelerate as AI becomes increasingly integrated into software and hardware operations. Conversely, however, the number of PSPs with no official approval process has increased from 7% in 2022 to 11% in 2024.

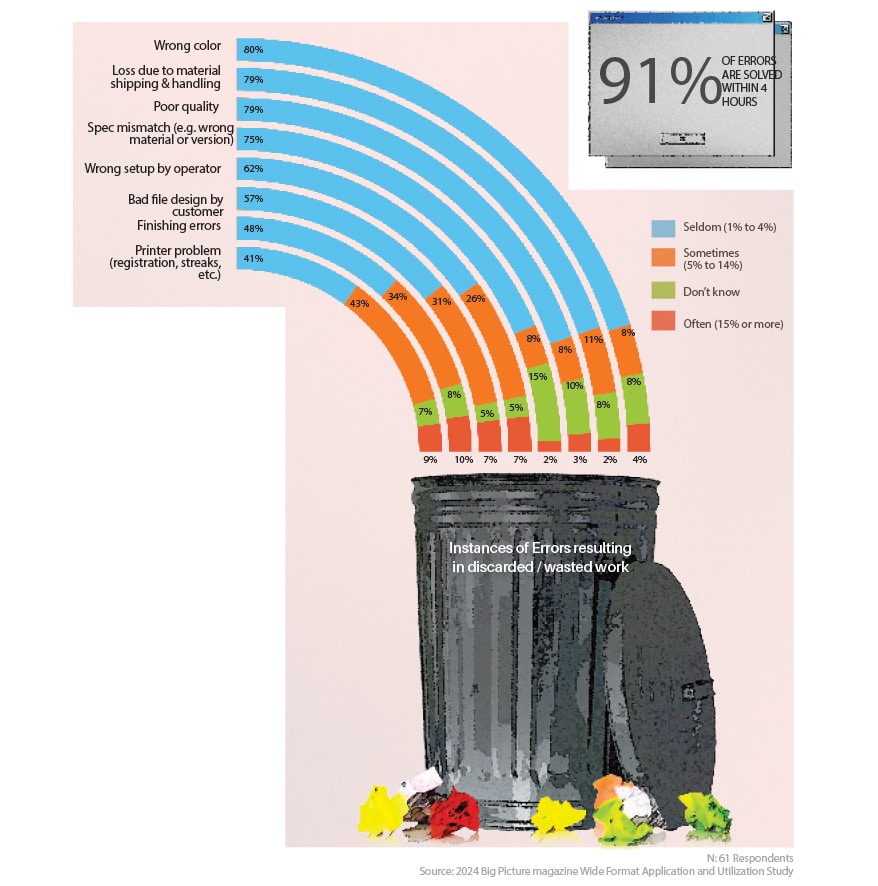

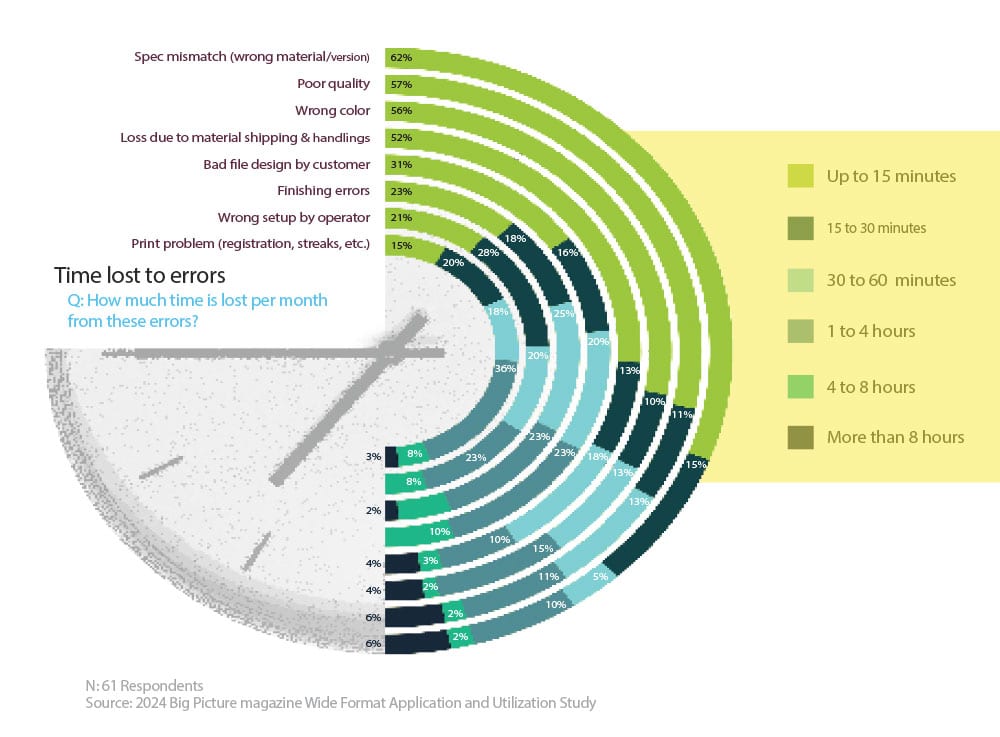

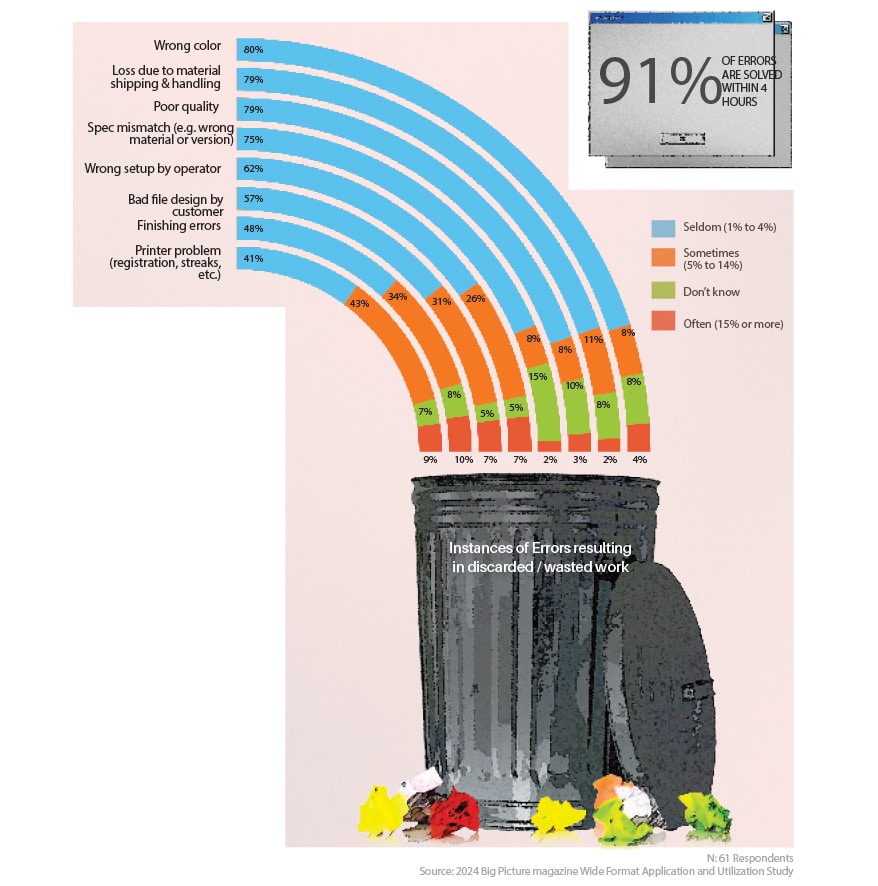

Even with a signed proof, mistakes will still happen. These errors, often leading to discarded or wasted print work, are mainly attributed to printer issues (10%) and finishing errors (10%). That being said, 65% (up from 48% in 2022) of overall errors seldom happen, 21% (down from 38%) sometimes happen, and only 5% (down from 9%), on average, happen often.

Additionally encouraging is that time lost due to printer errors is decreasing as well. This year, 91% (previously 87%) of errors were reported to be solved within four hours; 40% are resolved within 15 minutes, and just 3% take more than eight hours to solve.

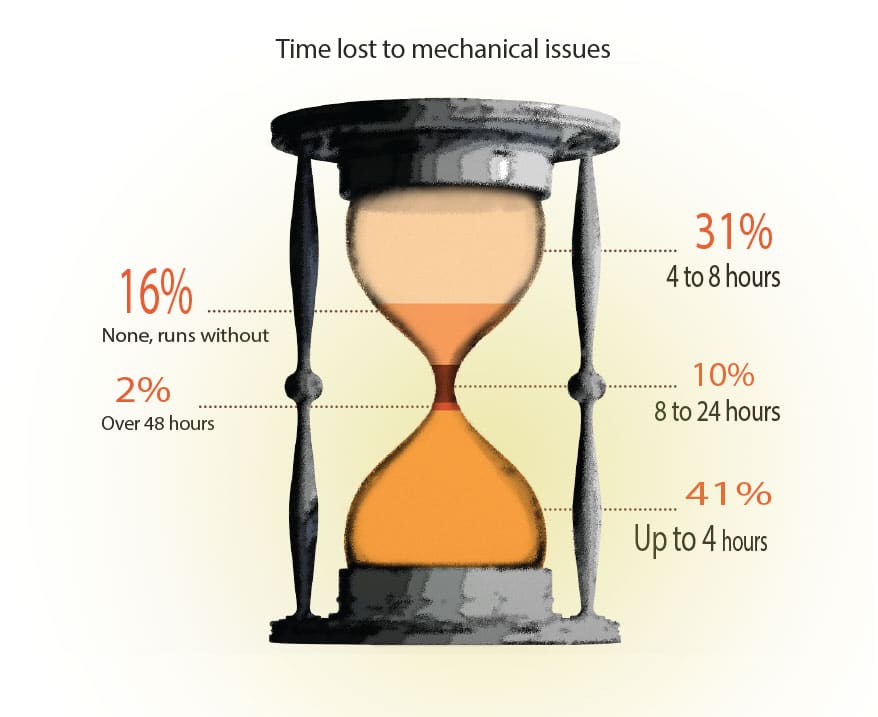

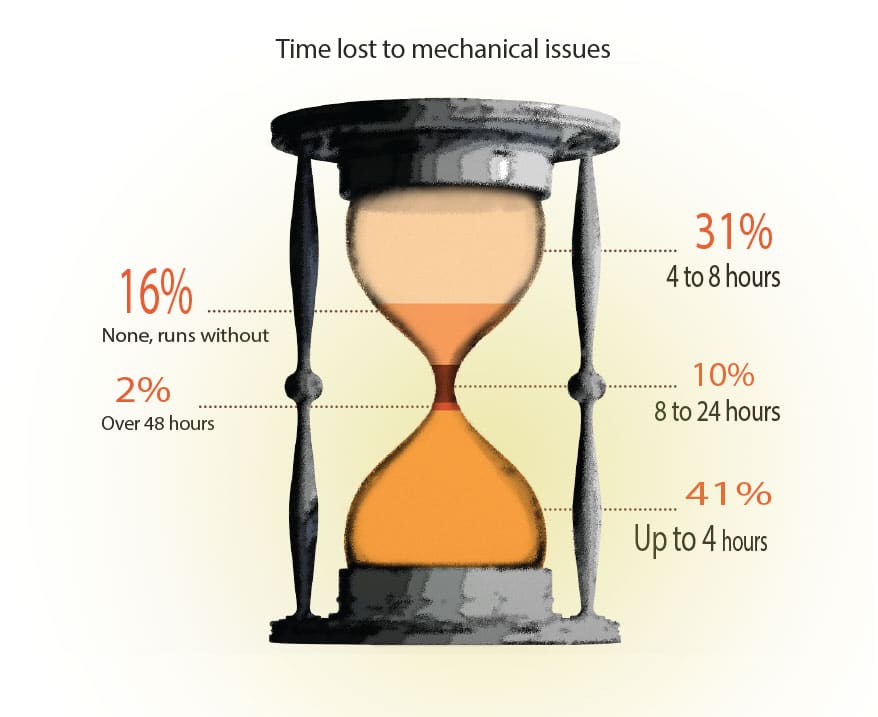

Mechanical issues with wide-format print devices continue to cause more downtime than specific workflow issues. While it is still advisable for PSPs to prioritize device redundancy to the greatest extent possible, the percentage of PSPs reporting monthly downtime of between 4 and 24 hours has decreased from 55% in 2022 to 43% in 2024 — with only 2% reporting issues that take longer than 48 hours to rectify. While diverse technology is a strong driver of growth, being sure to have backup printers in place is crucial to minimizing downtime from mechanical issues.

The Demand for Automation

Continues to Increase

In the past two years, we have seen an increased demand for faster turnarounds leading PSPs to look toward automation to reduce production time and decrease costly mistakes.

With the onset and inevitable increase of AI implementation in all aspects of business and social landscapes, we should expect PSPs to look toward utilizing automated workflow solutions to keep up with demand without lowering their margins.

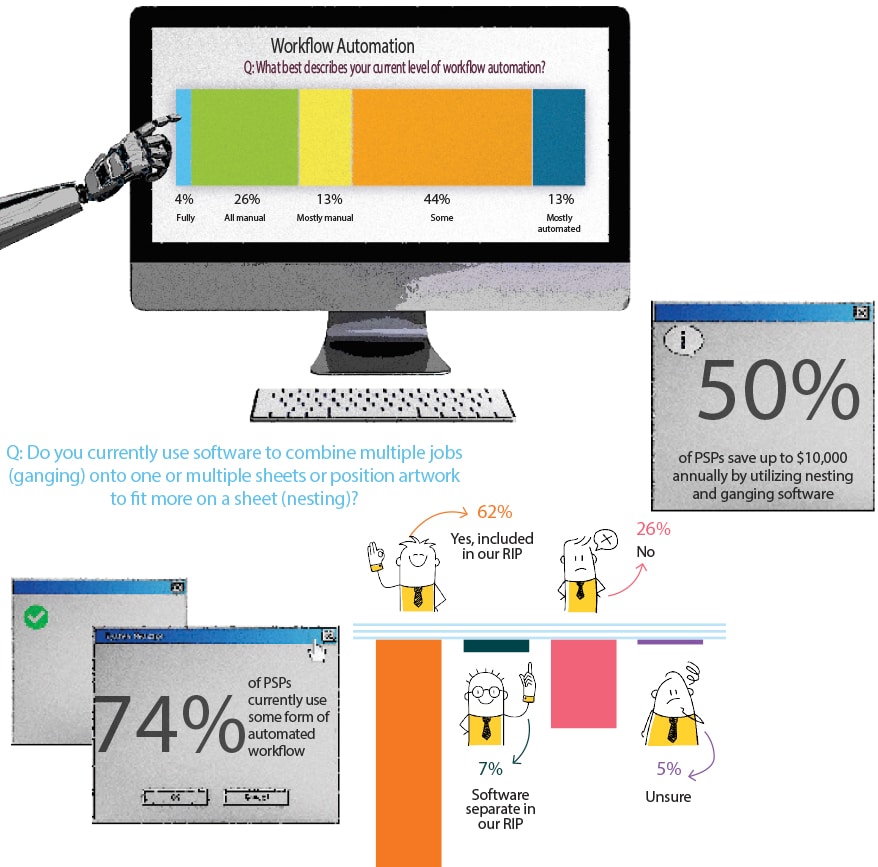

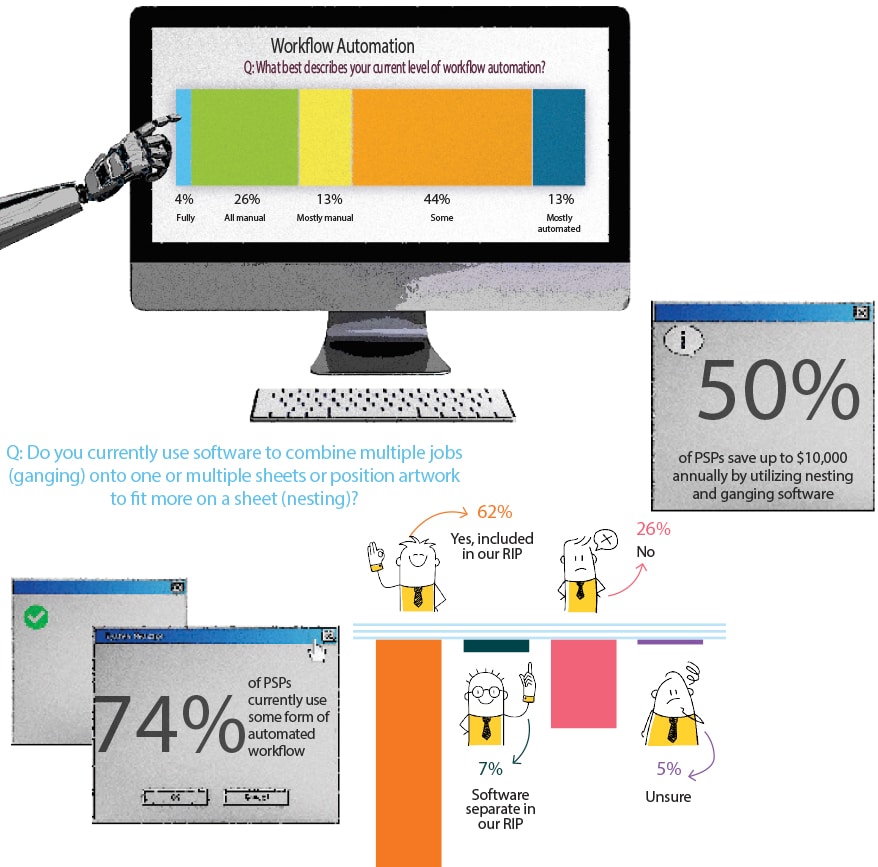

Interestingly though, it seems the overall percentages of PSPs utilizing automation have decreased from 90% in 2022 to 74% in 2024. Nuanced in this percentage change though, is the increase of the middle “some automation” group from 19% two years ago to 44% today. While we still are uncertain as to how AI will be implemented, we fully expect this trend to continue as PSPs face the ever-increasing challenge of “doing more with less.”

Waste Reduction

Is a Top Priority

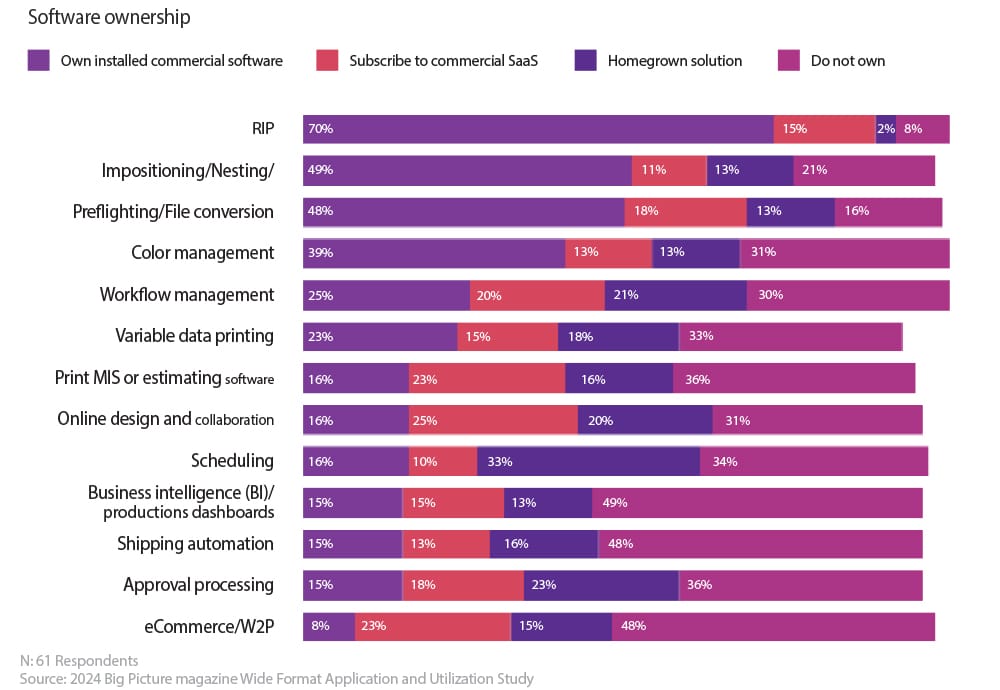

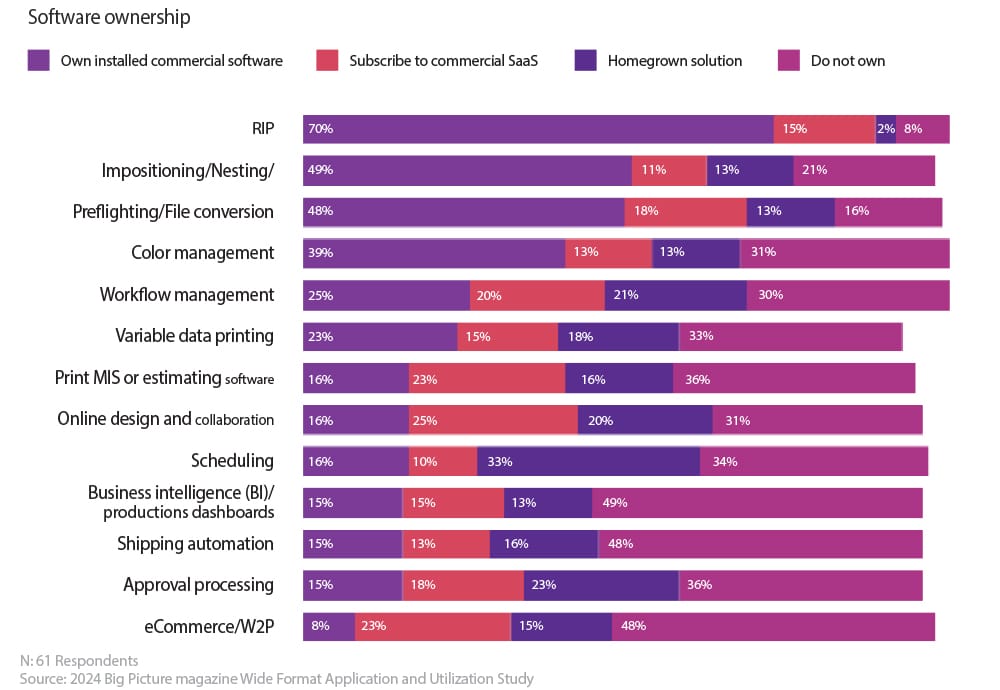

Waste reduction and workflow streamlining in production continue to be priorities in software and automation trends, catalyzing a dynamic shift in software ownership.

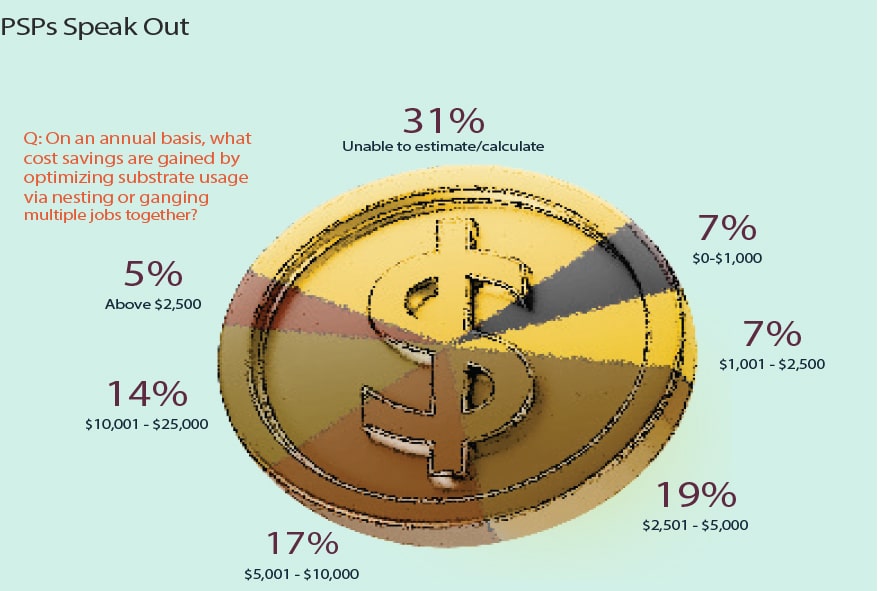

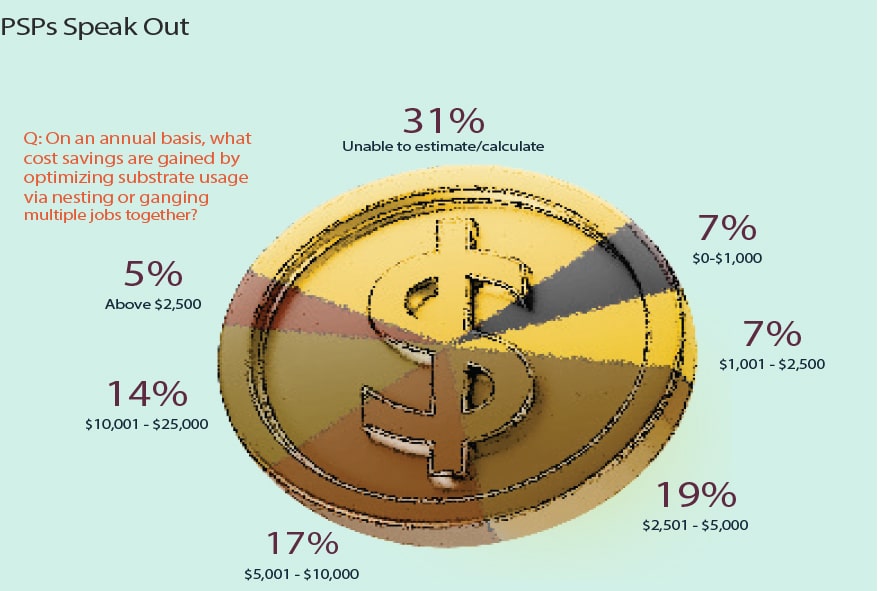

Nesting software is a prevalent tool within a PSP’s software toolbox with 69% of wide-format PSPs actively using nesting and ganging software features to optimize capacity and savings from load management. Annual cost savings gained by optimizing substrate usage with nesting and ganging software show 19% of PSPs saving $2,500 to $5,000, 17% saving $5,000 to $10,000, and 14% saving $10,000 to $25,000.

Migration to Software

Subscription Continues

While most RIP and nesting software still are run as an owner-installed component of the print workflow, we are starting to see more movement toward software as a service (SaaS) for workflow management, print MIS, design collaboration, and eCommerce (web to print).

As mentioned with hardware investment interest, software investment plans seem to be carefully thought out as well. While only 6% of PSPs are considering new software purchases, 15% will renew their SaaS subscriptions, with an additional 5% considering new subscriptions.

Revenue Increases Lead

to Investments is Business Systems

Respondents had mixed answers when asked about revenue in the past year. As was in 2022, 51% of the PSPs surveyed reported revenue of less than $1 million dollars, with 30% of that between $500k and $1 million. The majority, 33%, are claiming earnings of $1 million to $5 million, up 5% from 2022, with the remaining 15% above $5 million a year, up 11% from 2022. With an increase in revenue and GPM, investment interest is sure to follow. The interest has shifted over the years from new equipment purchases to software systems and the majority of those being subscriptions.

The wide-format printing industry is ever transforming, driven by the need for greater profitability, workflow optimization, and automation. While profitability is on the rise, PSPs must continue to focus on both high-demand and high-margin applications to maximize their returns. The increasing adoption of automation and SaaS models, coupled with a strong emphasis on error reduction, will be key to the continued success of PSPs in the coming years.

As AI and automation become more integrated into print workflows, PSPs have the opportunity to streamline their operations, reduce downtime, and improve overall profitability. By staying ahead of these trends and making strategic investments in both equipment and software, PSPs can ensure long-term growth and success in an increasingly competitive market.

N: 61 Respondents

Source: 2024 Big Picture magazine Wide Format Application and Utilization Study

Business Growth: Mark Coudray1 month ago

Business Growth: Mark Coudray1 month ago

Events4 weeks ago

Events4 weeks ago

Women in Wide Format3 weeks ago

Women in Wide Format3 weeks ago

Expert Perspectives2 months ago

Expert Perspectives2 months ago

Headlines2 months ago

Headlines2 months ago

Women in Wide Format4 weeks ago

Women in Wide Format4 weeks ago

Line Time2 weeks ago

Line Time2 weeks ago

Women in Wide Format1 month ago

Women in Wide Format1 month ago