SEGMENTS OF THE US economy that have been hard hit by the pandemic are showing signs of recovery. The stock market certainly has taken notice, as evidenced by the rotation out of high-flying technology stocks and into more cyclical companies that typically benefit during an economic recovery.

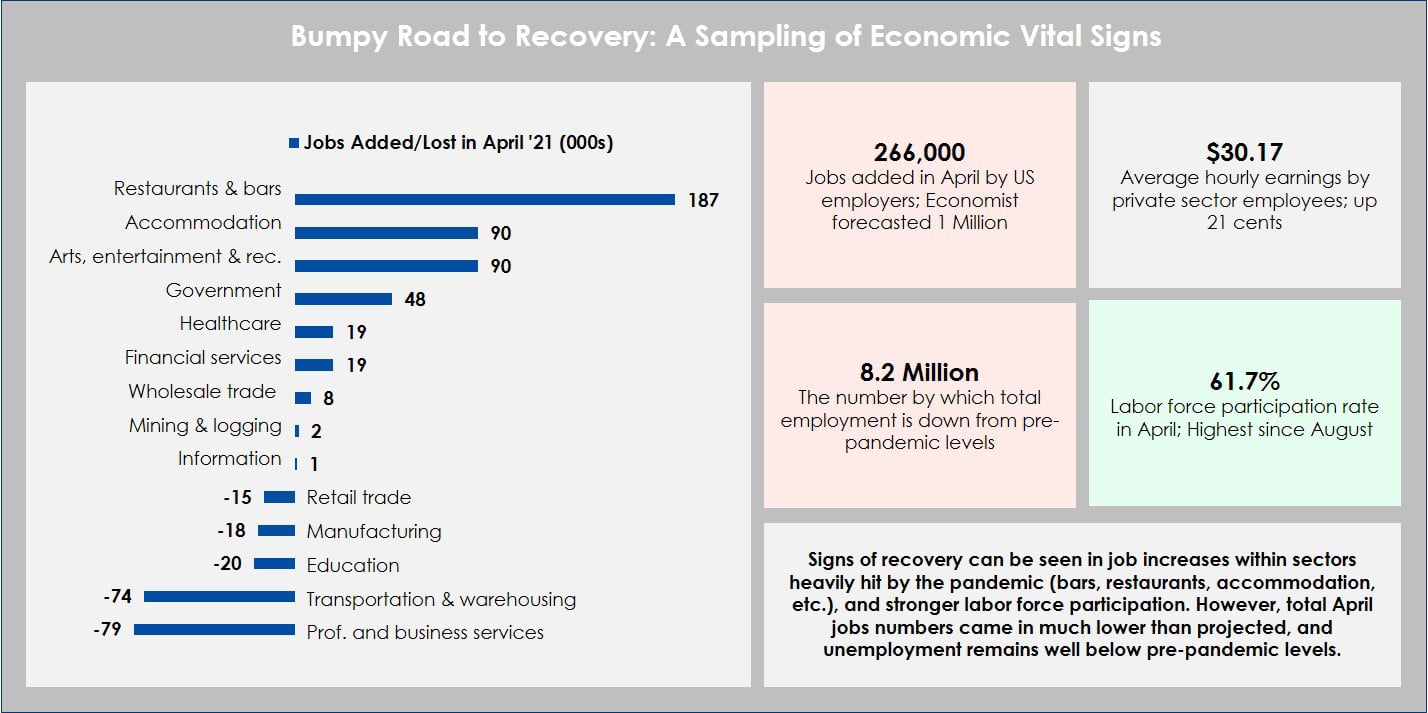

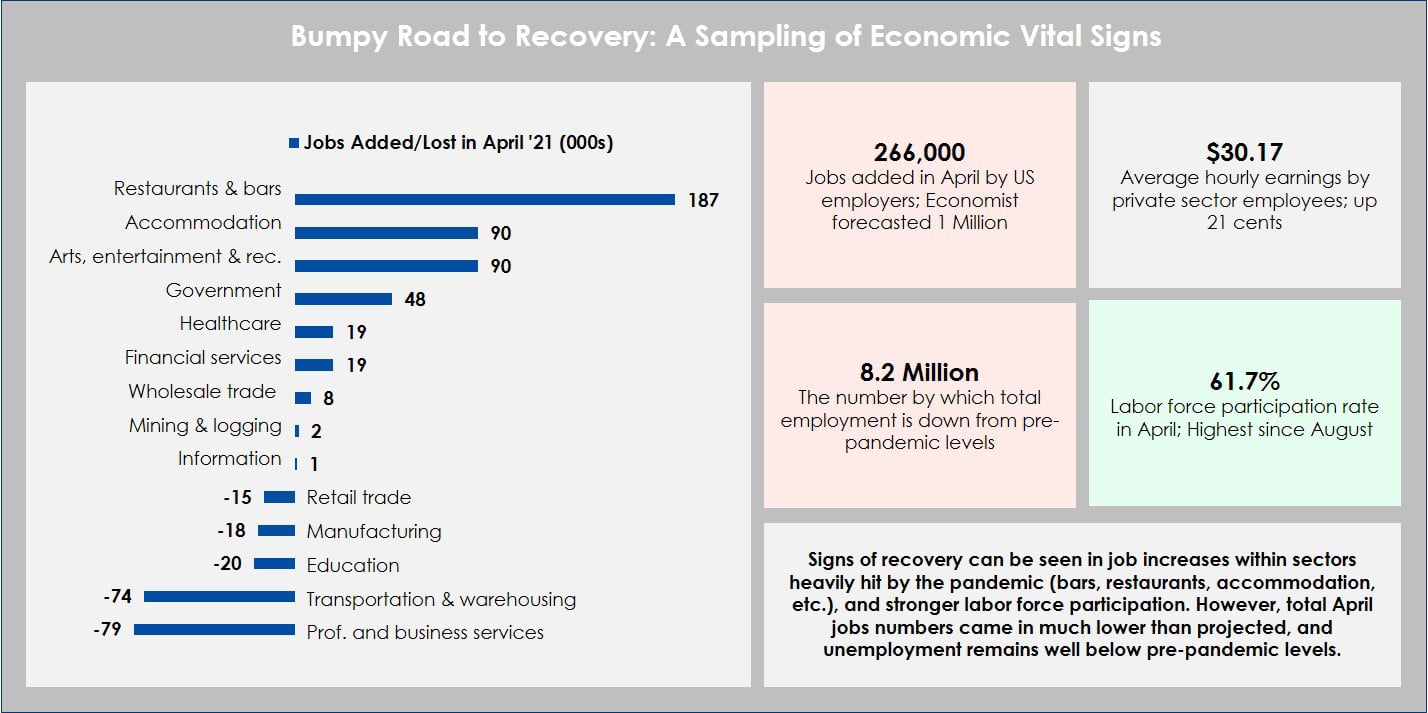

However, government employment data released last week presented a surprise to the downside – although economists forecasted one million jobs to be added, the current data shows only 266,000 new jobs for the month of April. On the bright side, the largest number of jobs added were in restaurants and bars, accommodation and arts, as well as entertainment and recreation. The labor force participation rate is now 61.7 percent – the highest it has been since last August.

All these verticals are important to the printing industry. Nevertheless, the number of unemployed remains 8.2 million below where it was pre-pandemic. Moreover, additional challenges include rising prices and shortages for a broad range of products and commodities, from semi-conductors, food staples, iron ore, wood pulp, etc. So, what does this all have to do with the printing industry? Frankly, everything.

The S&P has so far logged 25 record highs in 2021 due to the growing optimism in the US that there is light at the end of the tunnel as far as the pandemic is concerned. However, as evidenced by last week’s surprise (not to mention the volatility this week in the stock market), the economic recovery is choppy. This uneven path forward can be seen in the most recent survey fielded by Big Picture and Keypoint Intelligence of wide-format print service providers, commercial printers, and other types of printing establishments this past April.

Advertisement

The data from the survey illustrates that the printing industry is showing signs of recovery, but still faces challenges. Eighty-two percent of those surveyed are back to full operation, not all that different from a similar survey conducted in November 2020. However, only 41 percent are back to full operation and back to full staffing. Moreover, only some respondents have seen a moderate (37 percent) or big (one percent) increase in customer demand, while another 35 percent have seen only a small increase. As a result, it’s not surprising to see that year-over-year revenues were down 12 percent in the first two months of this year.

On the surface, this is not positive; however, this compares to an average decline in 2020 revenues of 26 percent, and the decline in revenues did not start until March. In short, demand is gradually returning. While we are not back to the 2019 level of revenues, lost ground is being made up. The gradual nature of the recovery in the printing industry means capital expenditures remain subdued; nearly two-thirds of printers do not plan to invest in new printing equipment in 2021.

The printing industry does have cause to be optimistic: the economy is clearly in recovery mode. Many printing establishments are seeing improvements in the business climate as customers within industries like hospitality and leisure, entertainment, as well as accommodation work to get back to normal business operations, and (by extension) purchase printed products. Nevertheless, the path to recovery will have its bumps in the road – one of which is the Colonial Pipeline on the east coast, which was shut down most of this week due to a ransomware attack. This means some of us may have to stay off the road for just a bit longer as we wait to fill up our gas tanks.

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Columns2 months ago

Columns2 months ago

Blue Print2 weeks ago

Blue Print2 weeks ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago