AS THE UNITED STATES grapples with the impact of the coronavirus, most states have implemented strict social distancing guidelines and have shut down large sections of their economies. The global response to COVID-19 has prompted such a sharp decline in economic activity that oil prices have hit unprecedented lows, south of $12 a barrel for West Texas Intermediate crude. The drop-off in demand for oil is so steep that the US is within weeks of running out of space to store it, and a trip to Starbucks now costs more than a barrel.

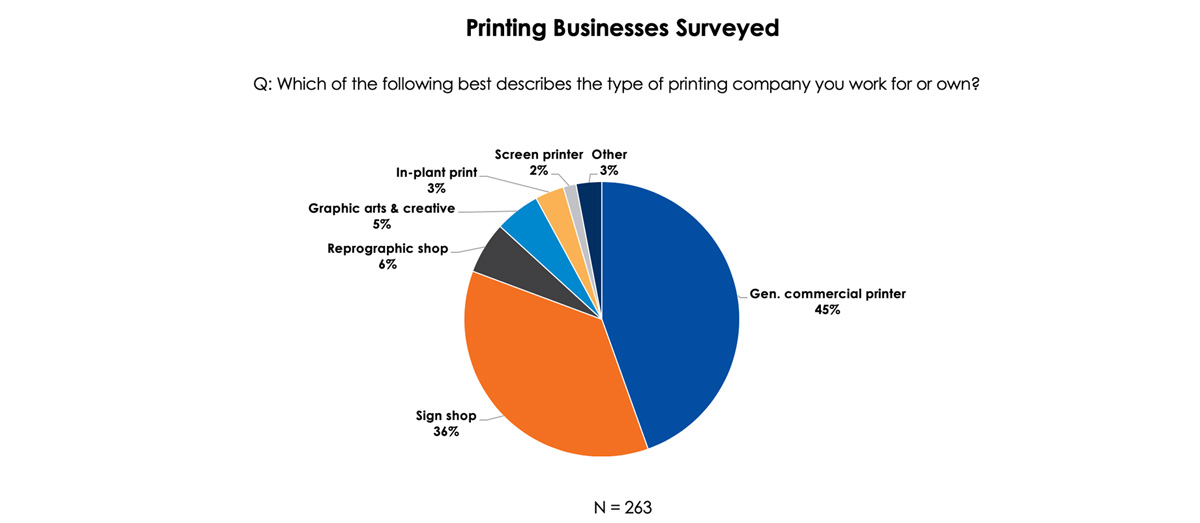

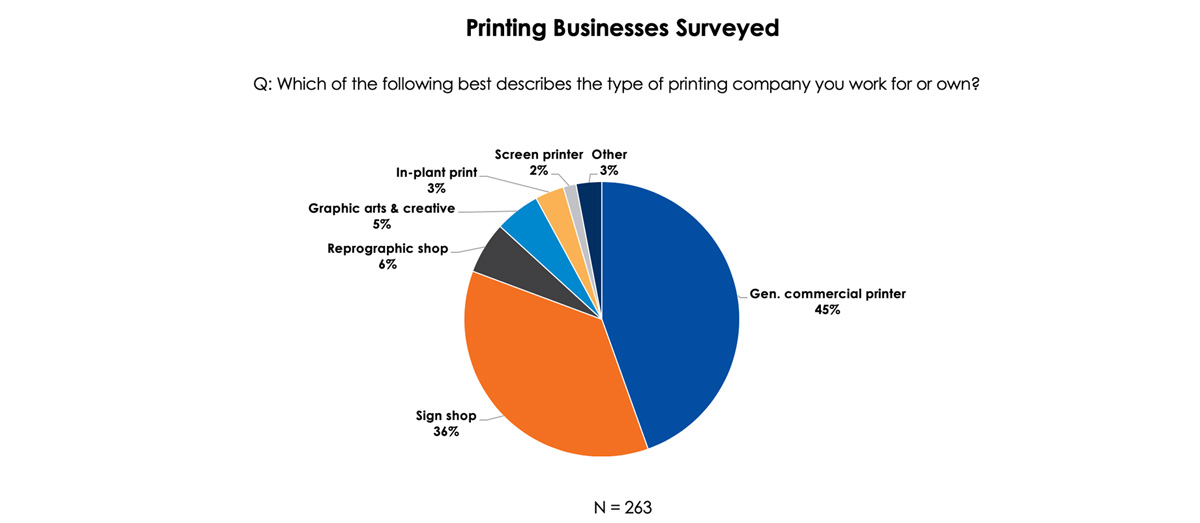

The US economy has not seen such a shock since the Great Depression and World War II. The damage to businesses and their employees is stunning. Those most vulnerable are small and medium-size companies that do not have cash on hand to weather such black swan events. To lessen the impact of the coronavirus, the CARES Act was signed into law on March 27. To gauge the impact of the pandemic on print service providers and their perceptions of the CARES Act, Keypoint Intelligence and Big Picture magazine surveyed PSPs from April 10 to 15. The findings of the survey reflect the stark reality of the times we are in, highlight signs of hope, and reveal the fact that confusion over the CARES Act is common.

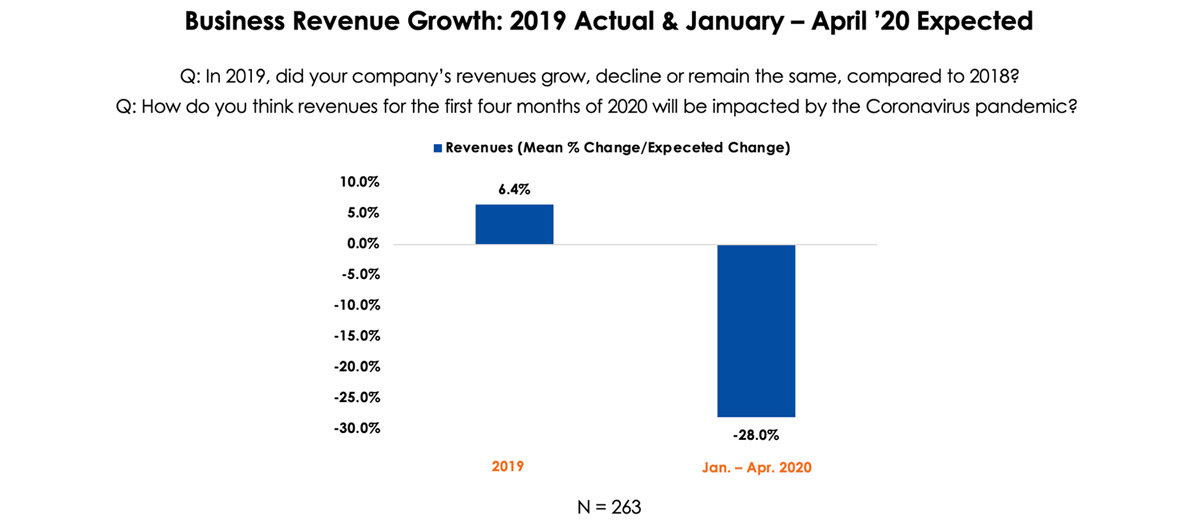

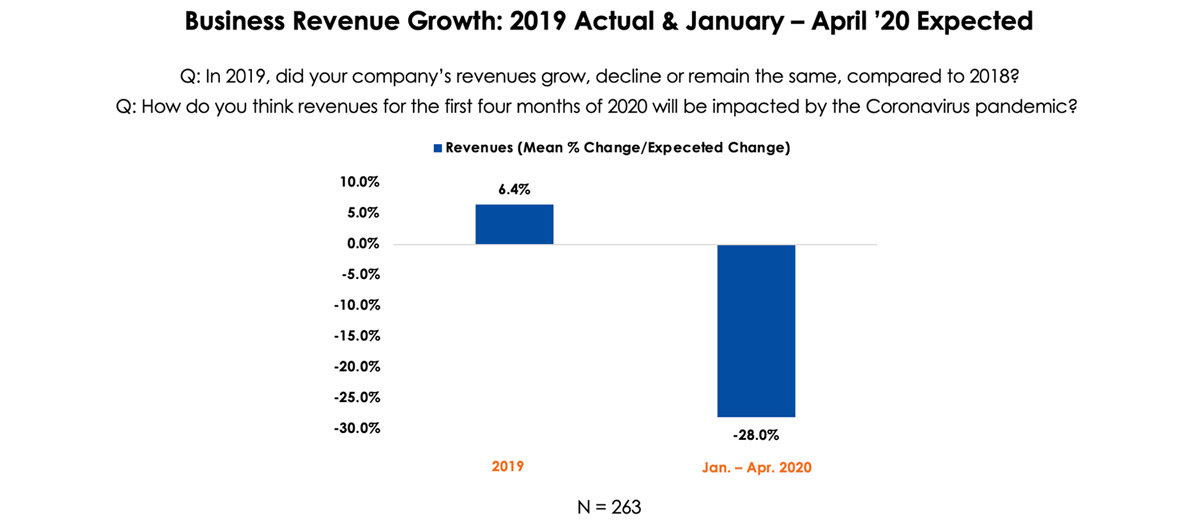

In 2019, these companies benefited from a strong economy. A solid majority of respondents cited that revenues were up by a respectable 6 percent. However, the expectation was that revenues would be down 28 percent in the first four months of 2020. Respondents were clear about how COVID-19 was impacting their business. Nearly 75 percent reported a significant drop-off in sales and cancelled orders. Another 40 percent stated they are running out of cash. One-third had to lay off employees. To summarize, the precipitous decline in business activity experienced by these PSPs matches what is happening in the broader economy.

There were positive findings, as well. Although PSPs are facing significant challenges, most are riding out the storm for the moment. For example, only 14 percent noted they had to temporarily close their business and less than 1 percent indicated their company went out of business. A solid majority have been able to avoid layoffs. Moreover, some have risen to the needs of today (16 percent) and modified production to focus on producing personal protective equipment (PPE).

Advertisement

Views regarding the CARES Act were mixed, however. On the positive side, 45 percent stated that it will help avoid layoffs by taking advantage of the federal grants offered, and 42 percent believed that it will help their business. However, this was matched by:

- 39 percent who indicated this was only a start and more help will be needed

- 37 percent who were uncertain about how this will affect their business

- 28 percent who did not believe help will come fast enough

Only 14 percent stated they will be able to get a short-term loan from their bank to hold them over. It turns out this concern was well founded because the $350 billion earmarked within the Paycheck Protection Program was exhausted within two weeks, with the unintended consequence of much of the funds not going to the small businesses who were the most in need.

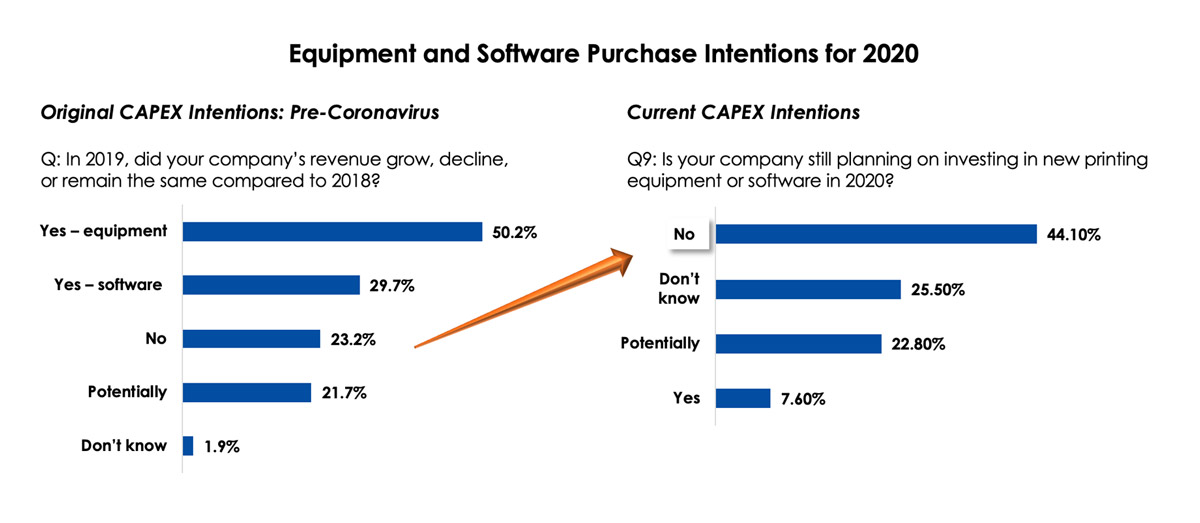

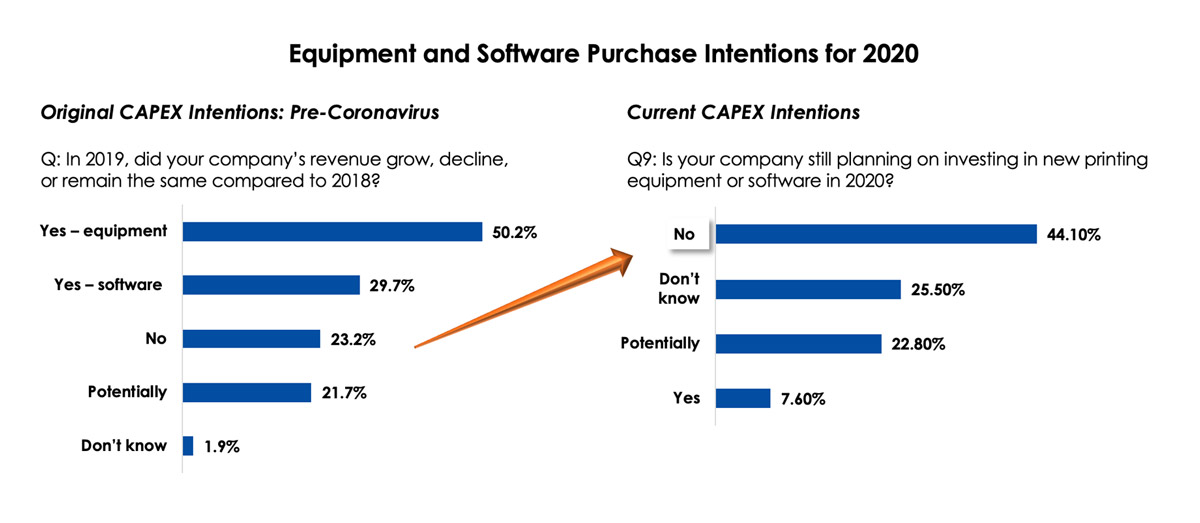

Confusion over the CARES Act’s impact appears equally strong as positive perceptions. Consequently, it is not surprising the coronavirus has profoundly impacted capital expenditure intentions for 2020. With a strong 2019 behind them, half of those surveyed fully intended to make equipment purchases and another 30 percent intended to purchase software. However, those calculations have been revised, with only 8 percent indicating a firm intent to purchase equipment or software in the current environment.

Fortunately, Congress and the president agree this is only a start and more help will be needed. On April 21, the Senate passed a $484 billion aid bill for small businesses, and it is expected this will be signed into law by week’s end. Help cannot come soon enough. When asked how long their businesses can exist financially based on the current conditions, the mean response was 3.7 months. With any luck, the second round of stimulus help will land in the right place and keep these companies in the ring long enough to help them see it through to the other side of this crises.

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Columns2 months ago

Columns2 months ago

Blue Print2 weeks ago

Blue Print2 weeks ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago

Best of Wide Format2 months ago